If you’ve ever caught yourself chasing a breakout at the top of a strong uptrend, only to watch price dump right after you enter, you’ve probably been hit by a shooting star candlestick pattern. It’s one of those classic candlestick patterns that usually marks the end of a bullish move and the start of a reversal.

The shooting star candle pattern looks simple, but it carries weight. It shows buyer exhaustion and early signs of selling pressure. But like any signal in trading, it only works when used in the right context. I’ve seen plenty of traders short blindly just because they spotted a long upper wick, and it rarely ends well.

In this post, I’ll break down what the shooting star candlestick really means, how to trade it properly, and the key mistakes to avoid. All the information on this page comes from 7+ years of trading experience, and I’m sure it will be valuable for most of you.

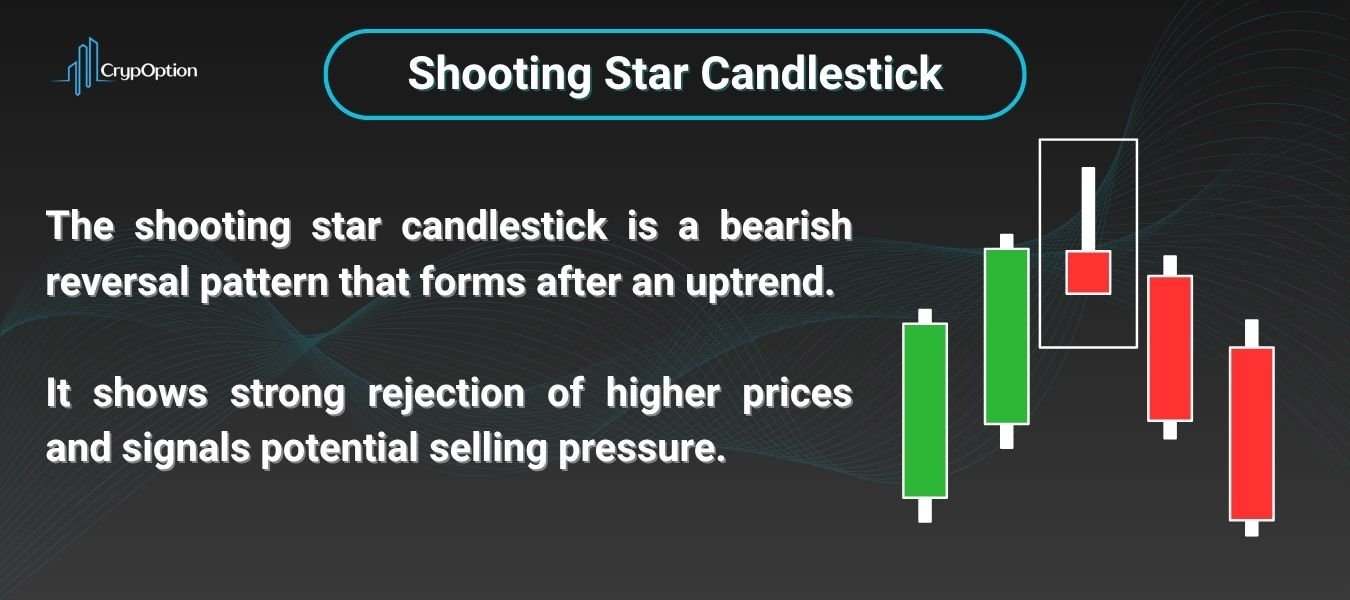

- The shooting star candlestick is a bearish reversal pattern that forms after an uptrend and signals potential rejection of higher prices.

- It has a small body near the bottom, a long upper wick, and little to no lower shadow, and ideally forms at resistance or supply zones.

- Confirmation is essential: a bearish close after the pattern, volume spike, or structural confluence increases its reliability.

- Never trade it in isolation. Use it with context, backtest thoroughly, and demo trade before risking real funds.

What Is the Shooting Star Candlestick Pattern?

The shooting star candlestick is a bearish reversal pattern that forms after an uptrend. It’s a single-candle formation with a small body near the bottom and a long upper wick. The wick is usually at least twice the size of the body, and the lower shadow is either very small or nonexistent. It looks like a star falling from the sky, hence the name.

Here’s the story behind it:

Buyers pushed the price higher during the session or the candle’s timeframe, but by the end, sellers stepped in and drove the price back near the open. That strong rejection of higher prices is what makes it a warning sign for bulls.

It’s not about the color. Both the red and the green shooting star candlesticks can work. But a red shooting star candlestick tends to carry more weight since it shows sellers fully took control by the close.

Anatomy of the Shooting Star Candlestick Pattern

To trade the shooting star candle pattern with confidence, you need to know exactly what it looks like — and what qualifies as a valid one.

Here’s what defines a true shooting star candlestick:

- Small body near the bottom of the candle

- Long upper shadow, at least 2× the size of the body

- Little to no lower shadow

- Forms after an uptrend or bullish price leg

- Ideally appears near a resistance level, supply zone, or after a sweep of liquidity

This shape tells you buyers tried to push the price higher, but got shut down. Sellers then drove the price back near the open.

It’s also important not to confuse it with other patterns that have long wicks. A clean shooting star trading pattern will always appear after bullish momentum. If it shows up during a range or downtrend, it’s likely not valid.

You might also ask if the green shooting star candlestick works. Technically, yes. But a red shooting star candlestick is stronger. It shows the candle not only rejected higher prices but also closed lower. It obviously gives more confirmation of selling pressure.

How to Spot the Shooting Star Pattern

The shooting star candlestick works best when it forms after a strong uptrend or a sharp bullish move. That’s when the market is stretched and buyers are starting to run out of steam.

The pattern becomes meaningful when it shows up at:

- A major resistance level

- A supply zone

- A key Fibonacci retracement level or psychological price point

- After a news-driven pump or an extended rally

- Following a sweep of liquidity with high volume

You’ll often see it on the 1-hour, 4-hour, or daily chart, especially in trending markets. But for binary options or short-term strategies, even the 5-minute or 15-minute shooting star can be useful. But, of course, as long as it lines up with the higher timeframe structure.

Note that a shooting star candlestick pattern in the wrong place means nothing. But when it forms at the top, with confluence and volume, it can signal a clean reversal setup. Don’t trade it just because it looks like a shooting star. Trade it because it makes sense in the bigger picture.

Why the Shooting Star Matters (And How to Confirm It)

As I’ve already mentioned multiple times, the shooting star candlestick isn’t just a candle with a long upper wick. It’s a clear sign that buyers may be losing control. After an uptrend, this pattern shows that the price was pushed higher during the session, but sellers stepped in and forced it back down near the open. That rejection of higher prices signals potential weakness in the trend and the possibility of a bearish reversal.

But spotting a shooting star isn’t enough. You need confirmation before acting. A strong bearish candle closing below the shooting star’s low adds real weight to the setup. It shows that sellers are following through, not just reacting.

Volume also matters. If the shooting star forms on a spike in volume, it usually means the rejection was aggressive and likely to hold. It’s even better that the pattern forms near a key resistance level or supply zone like an order block. And if you spot a bearish signal on momentum indicators like the Vortex Indicator or the Aroon indicator at the same time, it strengthens the case even more.

Additionally, you can use other bearish candlestick patterns, such as the Bearish Engulfing or Gravestone Doji, which can help you gain more confidence about the next move.

How to Trade the Shooting Star Candlestick Pattern

Trading the shooting star candle pattern starts with spotting the right market structure. Yet, the real edge comes from how you manage the trade around it.

Once you see a clean shooting star form after a strong bullish move, don’t rush in. Wait for the next candle to close. If it closes below the low of the shooting star, that’s your confirmation. That’s when sellers are showing they’re ready to take over.

Your entry can be right after that bearish close, or on a small pullback toward the pattern’s body or wick. The stop-loss should go a few points above the high of the shooting star, or a recent swing high. If the price breaks that level, the pattern is invalidated. So, no reason to stay in.

Now, the targets depend on your trading style. For short-term setups, aim for the nearest support zone or recent lows. If you’re using a fixed risk-reward ratio, 1:2 or 1:3 usually works well. Some traders measure the length of the wick and use it to project a 2x or 3x move downward, but I personally don’t do so and stick to the overall market structure rather than measured moves.

The key is to stay patient. The shooting star candlestick gives you a clear structure, but it still needs the right entry, stop, and target plan to be profitable. Let the market confirm your idea and then strike with precision. The image above is a perfect shooting star candlestick example, which shows you how I personally trade it.

Common Mistakes and Lookalikes to Avoid

You might confuse the shooting star candlestick with similar-looking patterns. These lookalikes may appear almost identical but signal very different market intentions. Trading them without understanding the context can lead to losses. Trust me, I’ve been there.

So, here’s a quick comparison table:

| Pattern | Wick Direction | Trend Context | Signal Type | Key Difference |

|---|---|---|---|---|

| Shooting Star | Long upper wick | After uptrend | Bearish reversal | Small body at bottom, signals rejection of higher prices |

| Inverted Hammer | Long upper wick | After downtrend | Bullish reversal | Same structure as shooting star, but opposite trend context |

| Hammer | Long lower wick | After downtrend | Bullish reversal | Opposite structure; lower wick shows rejection of lower prices |

| Gravestone Doji | Long upper wick, no real body | Usually after an uptrend | Indecision / Potential reversal | No body; shows hesitation, not confirmed rejection |

| Evening Star | Three-candle pattern | After uptrend | Bearish reversal | Needs a full structure with confirmation over 3 candles |

Always remember: the shooting star candle is only valid after a bullish move, with confirmation and context. Shape alone is not enough.

Pros and Cons of Trading the Shooting Star Candlestick

The shooting star trading pattern is a valuable tool in reversal trading. But like any price action signal, it has strengths and weaknesses. Let’s have a quick look:

| Pros | Cons |

|---|---|

| Easy to spot after a strong uptrend due to its distinct shape | Often fails without proper confirmation or follow-through |

| Helps identify potential tops and early reversal zones | Can trigger prematurely in strong bullish trends |

| Gives clear entry, stop-loss, and target structure | Must be used with context |

| Works across multiple timeframes and in various markets | Often confused with patterns like inverted hammers or gravestone doji |

The Psychology Behind the Shooting Star

The shooting star candlestick shows a shift in market sentiment. A shift from aggressive buying to sudden rejection. But to fully understand the shooting star candle pattern meaning, you need to look deeper than just price movement. This is a pattern that often forms at key supply zones or after a liquidity sweep, and that’s what gives it real significance.

Here’s what happens beneath the surface: after a strong bullish run, the price often reaches a level where retail traders get overly confident. Breakouts form, and traders jump in late, expecting the trend to continue. Smart money (institutional traders) knows this. They let price push into that level, triggering buy stops and breakout entries. The market sweeps the pool of liquidity just above a recent high.

Once enough buy-side liquidity is taken out and the big players have filled their orders, they unload their positions into that buying pressure. The shooting star candle ends up with a long upper wick and a close near the open.

The rejection is strong because it’s not just random sellers stepping in. A strategic shift in control from buyers to sellers is happening at a key level or a supply zone. This is the smart money handing the bag to late buyers.

That’s why context is everything. A shooting star candle at a random spot means little. But a shooting star that forms after a parabolic rally, right into a known supply zone, and with a clear sweep of previous highs, is dangerous. It’s dangerous for bulls, but a perfect opportunity for you.

Read More: What Is the Dragonfly Doji Candlestick Pattern?

Conclusion

Some traders swear by candlestick patterns, while others prefer indicators, price action models like the flag pattern or symmetrical triangle patterns, or more modern approaches like ICT fair value gaps, breaker blocks, etc. There’s no one-size-fits-all method in trading.

But the truth is, patterns like the shooting star candlestick still hold value, especially when used correctly. They can offer clear entry and exit signals when the price hits a key level, shows signs of rejection, and lines up with your overall bias.

That said, no candlestick pattern should be traded in isolation. The shooting star works best when combined with other forms of confluence, like supply zones, volume spikes, divergence, or structural breaks.

If you’re new to trading this pattern, don’t rush in with real money. Backtest it. Watch how it plays out across different markets and timeframes. Then move to a demo trading account to practice execution before risking capital.

And if you’re a binary options trader looking for a reliable broker, check out our brokers page for the best ones in 2025.

FAQs

Is the shooting star candlestick bullish?

No, the shooting star is a bearish reversal pattern. It forms after an uptrend and signals potential selling pressure and a shift in momentum.

Is the shooting star candlestick pattern accurate?

It can be accurate when used with proper context, like resistance zones, liquidity sweeps, or volume spikes. On its own, it’s not enough. Confirmation and confluence are key.

Is the shooting star pattern bullish or bearish?

The shooting star is a bearish pattern. It shows that buyers pushed the price up but failed to hold it, and sellers took control before the candle closed.