Looking for a way to trade options with lower costs, managed risk, and better potential returns than just buying calls or selling naked options? Well, you’re in the right place! If you know, you know! And if you don’t, no worries. I’m talking about one of the most effective options trading strategies out there: call spreads.

In this article, I’ll break down everything you need to know about call spreads: from the basics to more advanced tips. And at the end, I’ll also share one of the top platforms that could help you grow your profits big time, like 1000x big!

- Call spreads involve of buying and selling two call options with different strike prices but at the same time and also same expiration date.

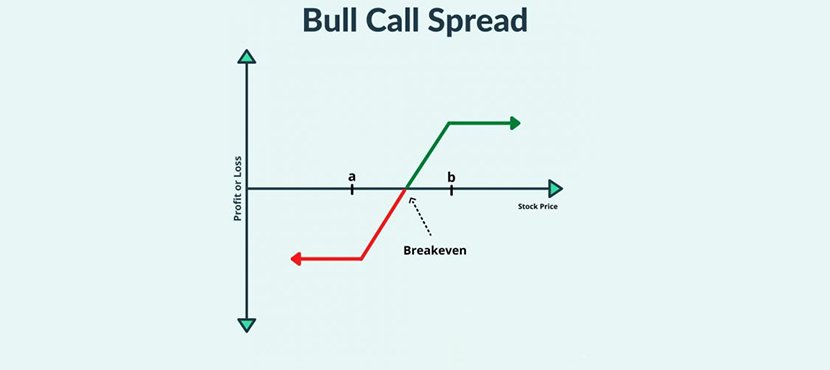

- Bull call spreads involve of buying one call option at lower strike price and sell another call option at higher strike price.

- Bull call spreads are used when you expect a moderate price increase.

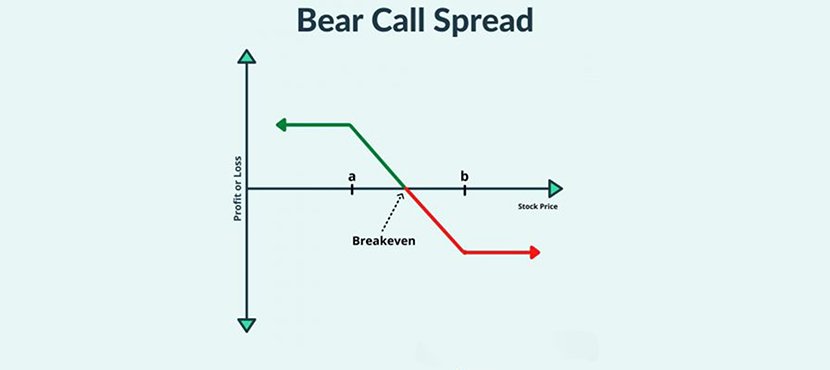

- Bear call spreads involve of selling one call option at or lower the strike price and buy another call option at a higher strike price.

- Bear call spreads are for slightly bearish markets.

What Are Call Spreads?

Call spreads are one of the most practical strategies in options trading. The idea is simple: you buy one call and sell another with the same expiration date, but with different strike prices.

Now, whether you buy first or sell first depends on the type of call spread you’re using: a bull call spread or a bear call spread. What makes this strategy useful is that it reduces your potential losses compared to trading a single call on its own.

In the next sections, I’ll explain how each type works and when you might want to use them.

Bullish or Bull Call Spreads

With bull call spreads, first, you buy a call option at a strike price that’s at or below where the market is. Then, at the same time, you sell another call option at a higher strike price.

This setup is also known as a Debit Call Spread because you pay a small amount (called a net premium) to enter the trade.

So, when do you use this? When you think the market will go up, but not like crazy high! Just a steady, moderate rise. You look at the chart, spot a possible uptick, and think: “Hey, I could make a profit even if the price doesn’t shoot through the roof!”

Still a bit fuzzy? No worries! I’ve got you. Let’s break it down with some examples.

Bull Call Spread Example

Imagine the current stock price is $100. Based on your analysis, you expect the market to move up moderately. So, here’s what you do:

You buy 1 call option with a strike price of $100, paying a premium of $7. At the same time, you sell a call option with a strike price of $110 and receive a premium of $3.

Because you paid $7 and received $3, your net cost (or net debit) to enter this trade is $4 ($7 – $3).

Now, let’s look at four possible outcomes at expiration:

- Stock price stays below $100

Both call options expire worthless because the stock didn’t reach either strike price. You lose the net debit of $4. This is the worst scenario, and that’s your maximum loss. - Stock price between $100 and $110 (for example, $105)

Your $100 call is in the money and worth $5 (because 105 – 100 = 5). The $110 call you sold is out of the money and expires worthless. So, your net profit is $5 (value of your call) minus the $4 you paid, which leaves you with $1 profit. - Stock price at breakeven: $104

Your $100 call is worth $4, and the $110 call is worthless. This means your gain exactly covers the $4 you paid, so you break even; no profit, no loss. - Stock price at or above $110 (for example, $115)

Your $100 call is worth $15 (115 – 100), but the $110 call you sold is now worth $5 (115 – 110). Because you sold this call, you owe $5. So, your net value is $15 – $5 = $10. After subtracting the $4 net cost, your net profit is $6. That’s your maximum profit.

Bearish or Bear Call Spreads

Another type of call spread strategy is called the Bear Call Spread.

Here’s how it works: you sell a call option at a strike price that’s at or below the current price, and then you buy a call option with a higher strike price.

This strategy is also called a Credit Call Spread because you actually receive money (a net premium) when you start the trade, unlike the bull call spreads, where you pay to buy the call option first.

With bear call spreads, you’re expecting the market to dip a little before going back up.

I know it might sound a bit confusing, but don’t worry! The next section will clear everything up and give you the full picture of how bearish call spreads work in options trading.

Bear Call Spread Example

Now, imagine you’re looking at a stock trading at $150. Your analysis tells you the trend might be bearish, so you decide to use a bear call spread strategy.

You sell 1 call option at a strike price of $150 (at-the-money) and get paid an $8 premium. At the same time, you buy 1 call option with a strike price of $160 (out-of-the-money) and pay a $3 premium.

This means your net credit (the money you receive upfront) is $5 ($8 received minus $3 paid). This $5 is also the maximum profit you can make from this trade.

Just like before, let’s look at the possible outcomes at expiration:

- The stock price stays below $150

Both calls expire worthless because the stock didn’t reach either strike price. You keep the full $5 credit, which is your maximum profit. - Stock price is between $150 and $160 (for example, $155)

The $150 call you sold is in the money, worth $5 (155 – 150). The $160 call you bought is still out of the money and worth $0.

So, your loss on the short call is $5, but since you received $5 upfront, your net loss is zero! This is your break-even point. - The stock price is slightly above $150 but below the breakeven (like $153)

Here, the $150 call is worth $3, and the $160 call is worthless.

You owe $3 on the short call, but since you got $5 upfront, your net profit is $2 ($5 – $3). - Stock price is at or above $160 (for example, $165)

The $150 call you sold is worth $15 (165 – 150). The $160 call you bought is worth $5 (165 – 160). Your net loss is $15 – $5 = $10, but after subtracting the $5 credit you received, your maximum loss is $5.

Call Spreads: Benefits and Drawbacks

Like any options trading strategy, call spreads have their own pros and cons. Here are some of the biggest advantages:

- Limited Risk: In a call spread, your maximum loss is limited to the net premium you paid (in a debit spread). So, you know exactly how much you can lose upfront.

- Lower Cost: Selling the higher strike call helps offset some of the cost of buying the lower strike call, making it cheaper than just buying a call option alone.

- Defined Profit Potential: You know your maximum profit right from the start because it’s capped by the difference between the strike prices. This makes it easier to manage your risk and plan your trade.

But of course, there are some downsides too:

- Capped Profit: Your potential profit is limited by the strike price of the call option you sold, so if the stock price jumps significantly, you won’t get those extra gains.

- More Complex: Since you’re dealing with two call options instead of one, it’s a bit more complicated than just buying a single call or put. You need to understand how the two options work together.

- Higher Commissions and Fees: Because you’re trading two options contracts instead of one, the commissions and fees can add up and be higher.

| Pros | Cons |

|---|---|

| Limited Risks | Capped Profit |

| Lower Cost | Complexity |

| Defined Profit Potential | Double Commissions and Fees |

Where to Start Trading Call Spreads?

Okay, now that you have a good idea about call spreads and how they work, let me share something I found a few months ago. I was searching for the best binary options demo accounts, and I suddenly ended up on a binary options trading platform called Nadex. Turns out, they also offer a pretty cool and unique way to trade call spreads.

Some of you might not be familiar with Nadex or their call spread feature. Even though I’ll explain Nadex call spreads here, if you want to learn more about the platform itself, check out our full Nadex review for 2025. It’s my honest take on the platform.

Alright, enough intro! Let’s dive into the details of Nadex call spreads!

Trading Nadex Call Spreads

Think of Nadex call spreads like a simplified, better version of the call spread strategy I explained earlier. It optimized the complicated parts and the downsides. Instead of taking multiple trades, a Nadex call spread is just one contract. Plus, you can choose from different markets, like currencies, commodities, and stock index futures.

With traditional call spreads, you have to select two strike prices yourself. But with Nadex, they do that for you by setting a floor and a ceiling price in a single contract. These work just like the lower and higher strike prices.

So, each Nadex call spread has:

- A floor (the lowest price level), which is like the lower strike price

- A ceiling (the highest price level), like the higher strike price

The market price moves somewhere between these two, and you decide whether to:

- Buy the spread if you think the price will go up

- Or sell the spread if you think it will go down

Discovering Nadex: A Unique Way to Trade Call Spreads

Okay, so Nadex makes trading call spread contracts pretty simple, but you still gotta understand how it all works before jumping in. And guess what? Yeah, it’s time for an example!

Let me walk you through a real scenario with Nadex call spread contracts on the S&P 500 Index Futures. Here’s what you need to know about this contract:

- Floor Price: 3355.00

- Ceiling Price: 3395.00

- Current live price: 3357.00

- Current bid/offer: 3357.80 / 3358.10

You might be wondering why the price (the offer) is a bit higher than the current market price. That extra bit is called the premium. Think of it like paying for protection where the floor and ceiling prices keep your losses limited, no matter what happens in the market, and that protection costs you a premium.

This premium depends mainly on two things:

- Time: The more time left until the contract expires, the higher the premium. Less time means a cheaper premium.

- Volatility: If the market volatility rises, the premium goes up, too.

Alright, back to our example. Imagine you’re feeling bullish (you think the market’s gonna go up), so you decide to buy one US 500 call spread from 3355.00 to 3395.00 at the offer price of 3358.10.

Here’s what that means for you:

- Your maximum risk is the difference between the buy price and the floor price: 3358.10 – 3355.00 = 3.1 points, or $31 per contract.

- Your maximum profit is the ceiling price minus the buy price: 3395.00 – 3358.10 = 36.9 points, or $369 (fees not included).

Possible outcomes:

- If the index ends up below the floor (3355), you lose your $31 premium.

- If it finishes above the ceiling (3395), you hit your max profit of $369.

- If you close the contract early at 3385, your profit is 3385 – 3358.10 = $269.

- If it settles at 3375, your profit is 3375 – 3358.10 = $169.

- If you cut your losses and close at 3356.10, your loss is 3358.10 – 3356.10 = $20 (plus fees).

Why Use Nadex Call Spreads?

Nadex call spreads are a great way to take advantage of short-term market moves. Here are some other features that make them really stand out:

- They have a fixed floor and ceiling, so you always know your price range

- Your risk and potential reward are clearly defined from the beginning

- It’s a single, straightforward contract. No need to manage multiple positions

- Plus, you have the flexibility to close the trade early or let it run until expiration

Conclusion

And that’s a wrap on call spreads in options trading! At its core, it’s all about using two call options with the same expiration date, and depending on whether you think the market’s going up or down, you can buy or sell accordingly.

If this strategy makes sense to you and seems like a good fit, platforms like Nadex are worth checking out. They offer specialized call spread contracts that are perfect for short-term market moves.If you found this article helpful, I’d love to hear your thoughts in the comments below. And for more tips and strategies, be sure to stick around with us here at Crypoption.com.