The Gravestone Doji candlestick pattern might look simple, but it sends a strong message: buyers lost the fight. This pattern is one of the clearest signs of rejection at the top of a move. Price shoots up, stalls, and closes right back where it opened. That’s not just hesitation, it’s potential reversal.

But like any candlestick, the Gravestone Doji means nothing without context. Just because it looks bearish doesn’t mean it always works. You need to understand where it forms, how it fits into the bigger picture, and what confirmation looks like.

In this guide, I’ll break down the Gravestone Doji in plain terms, show you how to trade it and compare it with the Shooting Star so you don’t mix them up.

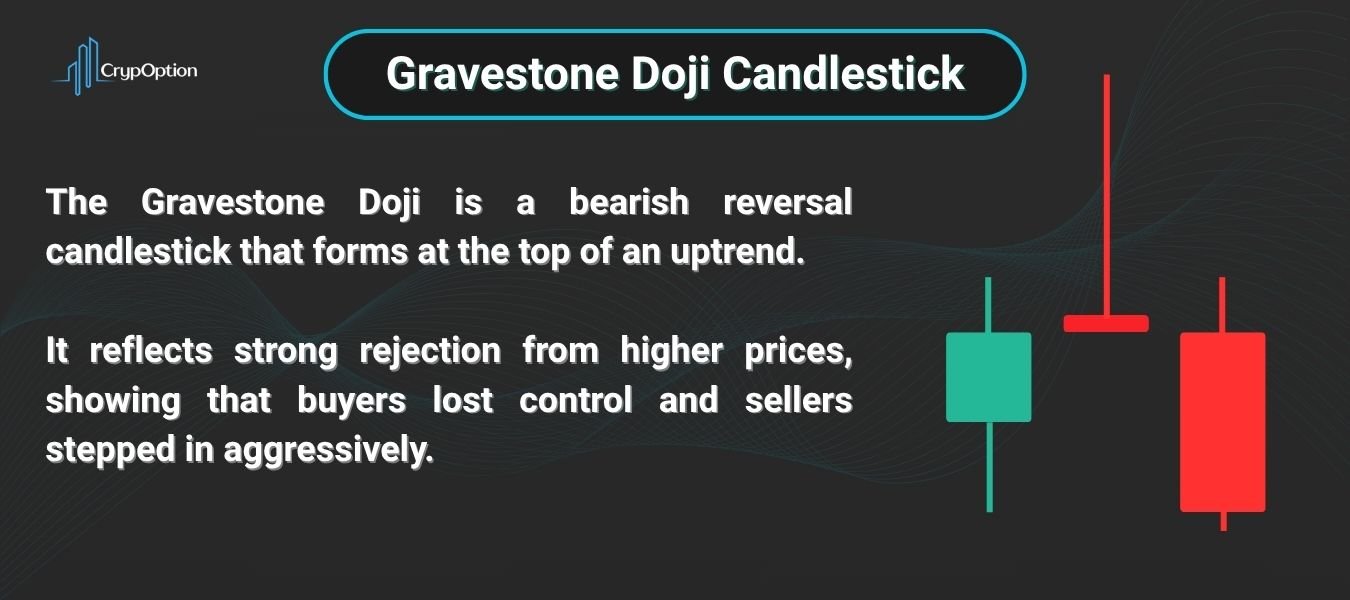

- The Gravestone Doji is a bearish reversal candlestick that forms after an uptrend, showing strong rejection from higher prices.

- It has a long upper wick, little to no lower wick, and a flat or near-flat body—signaling buyer exhaustion and potential selling pressure.

- Context matters: the Gravestone Doji is most effective near key resistance zones, after a parabolic move, or during liquidity sweeps.

- Use proper risk management: stop-loss above the wick, realistic TP targets, and a minimum 1:1.5 RR.

- Don’t confuse it with the Shooting Star—while similar in shape, the Gravestone Doji has almost no body and offers different strength levels.

What Is the Gravestone Doji?

The Gravestone Doji is a single-candle pattern that signals a potential bearish reversal. It’s easy to spot. The candle has a flat or near-flat body, with a long upper wick and little to no lower wick.

This shape tells a story. During the session (the candle’s trading period), buyers pushed the price up. But by the end, sellers had taken control and dragged the price right back to the open. That’s a clear sign of rejection.

It looks like a “T” flipped upside down, and that’s fitting. The Gravestone Doji often appears at the top of an uptrend, warning that the trend might be over. It looks exactly the opposite of what the Dragonfly Doji looks like, and also means the opposite.

Gravestone Doji Meaning in Trading

The Gravestone Doji shows a clear shift in momentum. Buyers were in control early, pushing the rice higher. But they couldn’t hold it. By the close, sellers stepped in hard and brought the price back down to where it opened.

This kind of price action tells us two things:

- Buyers are losing strength.

- Sellers might be ready to take over.

That’s why the Gravestone Doji is seen as a bearish reversal pattern, especially when it forms after a strong uptrend or at a key resistance level.

But here’s the truth: it’s not a confirmation on its own.

It only shows potential. You need the next candle to close bearish (and strongly so), ideally below the Doji’s body. That follow-through confirms that sellers are really dominant.

Also, watch the volume. If the Gravestone Doji forms with high volume, it’s a stronger signal, because it shows that liquidity has been taken and large institutional traders are executing their shorts. These traders, AKA the smart money, are those you want to follow.

How to Trade the Gravestone Doji Candlestick Pattern?

Trading the Gravestone Doji starts with one rule: don’t trade the candle, trade the confirmation.

As I’ve already mentioned, just spotting the pattern isn’t enough. Many traders jump in too early, only to get trapped in a fake reversal. Here’s a step-by-step guide that actually works:

1. Spot the Pattern at the Right Location

Look for a Gravestone Doji at:

- Near the top of an uptrend

- Near a strong resistance zone

- After a parabolic move or overbought conditions

- Following a clear buy-side liquidity sweep

- Inside a fair value gap or an order block

If it shows up in the middle of a range or downtrend, ignore it. You’ll be better off more often than not.

2. Wait for Confirmation

It’s better for the next candle to close bearish and ideally break below the Gravestone Doji’s body. This confirms that sellers are in control.

No confirmation? No trade.

3. Set Entry and Stop Loss

The next step is obviously setting an entry order or executing one at the market:

Entry:

- After the confirmation candle closes

- Or on a slight pullback into the Doji’s wick (if you want a better entry)

Stop Loss:

- Just above the high of the Gravestone Doji wick if you’re an aggressive risk-taker

- Give it some breathing room (above recent highs), especially on volatile pairs, or if you’re more conservative

4. Choose a Smart Take Profit Target

Don’t go for random TP levels. Use:

- Recent support zones

- A liquidity pool in discount

- Or set a fixed risk-reward ratio (1:1.5 minimum is ideal)

5. Add Confluence for Stronger Setups

As the Gravestone Doji is a reversal pattern, it’s better to use it with other concepts or indicators. The Gravestone Doji works best when it lines up with:

- Resistance zones

- RSI bearish divergence

- Trendline rejections

- Volume spikes

- Liquidity hunts

The image below shows a clear example of a trade taken using the Gravestone Doji candlestick pattern, and all the steps mentioned above.

Gravestone Doji Candlestick Pros and Cons

All strategies and trading concepts have their own share of benefits and drawbacks. Here’s a brief overview of the Gravestone Doji candlestick’s pros and cons:

| Pros | Cons |

|---|---|

| Easy to spot after a strong uptrend due to its distinct shape | Often fails without proper confirmation or follow-through |

| Helps identify potential tops and early reversal zones | Can trigger prematurely in strong bullish trends |

| Gives clear entry, stop-loss, and target structure | Must be used with context |

| Works across multiple timeframes and in various markets | Often confused with patterns like inverted hammers or shooting stars |

Gravestone Doji vs Shooting Star: What’s the Difference?

At first glance, the Gravestone Doji and the Shooting Star can look almost identical. Both have long upper wicks and suggest bearish pressure after a failed rally. But once you understand the mechanics behind each one, the differences become clear, and they matter when you’re trading real money.

The key difference lies in the body size and structure.

A Gravestone Doji opens and closes at nearly the same price. There’s little to no real body. This tells us the battle between buyers and sellers ended in a stalemate, but sellers had the upper hand by the close. It’s a sign of pure rejection.

A Shooting Star, on the other hand, has a small real body near the bottom of the candle. That small body shows slight bullish or bearish momentum, but the dominant signal is still the long upper wick, rejection from higher prices. Yet, there is no denying that a bearish closing shooting star is stronger than a Gravestone Doji, as it demonstrates a small bearish body on top of a long wick.

| Feature | Gravestone Doji | Shooting Star |

|---|---|---|

| Body | Almost no body (open and close nearly equal) | Small real body near the low |

| Wick | Long upper wick, little or no lower wick | Long upper wick, small or no lower wick |

| Signal Type | Bearish reversal | Bearish reversal |

| Reliability | Stronger when volume is high and trend is extended | Reliable with confirmation and confluence |

| Common Mistake | Misused without confirmation; confused with inverted hammer | Assumed to work alone; confused with Gravestone Doji |

Pro Tips for Trading the Gravestone Doji

I’ve been trading for more than 5 years now, so I think I can share some of my experience with you. Here are some pro tips for trading the Gravestone Doji:

Trade on Higher Timeframes with Strong Preceding Trends

Gravestone Dojis located on daily, weekly, or monthly charts pack more punch than those on 5‑minute bars. The longer and stronger the prior uptrend, the more likely the pattern signals a meaningful reversal.

Confirm with High Volume or Liquidity

A Gravestone Doji accompanied by above-average volume is far more reliable. It shows that many traders recognized the rejection, and it is a stronger bearish signal. Also, avoid low‑liquidity or choppy markets like the Asian session, since isolated Gravestone Doji under such conditions often misfire.

Look for the “Perfect Gravestone” Setup

The most powerful version appears after two consecutive bullish candles, followed by the Gravestone Doji, and then a strong bearish confirmation candle. This sequence is sometimes called the “perfect Gravestone Doji” and is more likely to trigger true reversals.

Combine with Trendlines or Moving Averages

If the Gravestone Doji forms near a major resistance trendline, at a bearish flag pattern‘s high, or after price pulls back to a moving average, it adds extra weight to the signal. Price rejection at these confluence zones increases the odds of a successful trade.

Use RSI/MACD to Spot Overbought or Momentum Shifts

When the Gravestone Doji aligns with RSI divergence or MACD crossing negative, it confirms buyer exhaustion and strength shifting to sellers. Look for these tools to add conviction to your trade decisions.

Manage Risk: Stop Above Shadow + Adjust for Volatility

Always place your stop-loss at least just above the candle’s upper shadow, but give extra buffer if volatility is elevated. Also, don’t set it too far, because we just want to capture one leg. If the stop becomes too wide relative to the expected reward, it may just not be worth it.

Use It as an Exit Signal on Long Trades

A Gravestone Doji can also help you lock in profits. When it pops up near obvious resistance and is followed by bearish momentum, it’s often a good cue to close long positions before a pullback.

Conclusion

The Gravestone Doji is more than just a candle with a long wick; it’s a message from the market. It shows clear rejection from higher prices and a possible shift in momentum. But like any pattern, it’s not a guaranteed signal.

If you treat it as a warning, not a trigger, it becomes powerful. Wait for confirmation, use confluence, and always consider the bigger picture. Whether you’re spotting a top, managing risk, or tightening your exit, understanding how the Gravestone Doji works can help you a lot.

Don’t just memorize it. Study it. Backtest it. Practice it on demo accounts. And only trade it when the context is in your favor. Let the market prove it’s ready, then you strike.