The Dragonfly Doji candlestick might look odd at first. It’s just a flat body with a long tail hanging below. But don’t ignore it. This pattern can signal a sharp shift in control. Sellers pushed the price down hard… but buyers stepped in, fought back, and closed it right where it opened. That’s not weakness. It shows buyers’ strength.

Still, the Dragonfly Doji isn’t a guaranteed bullish signal. Like all candlestick patterns, it’s just one piece of the puzzle. You can’t trade it in isolation. Where it shows up, what came before it, and what comes next; all of that matters more than the pattern itself.

In this guide, I’ll break down what the Dragonfly Doji really tells you and how to trade it with confirmation or add it to your overall strategy.

- The Dragonfly Doji is a bullish reversal pattern that shows rejection of lower prices and buyer strength.

- It forms when the open, close, and high are nearly the same, with a long lower wick and no upper wick.

- For high-probability setups, it should appear after a downtrend and near key areas like demand zones, FVGs, or after liquidity sweeps.

- Always wait for confirmation from the next bullish candle before entering a trade.

- In binary options, the Dragonfly Doji can improve short-term entries, especially on 1- to 5-minute charts with proper confluence.

What is a Dragonfly Doji Candlestick?

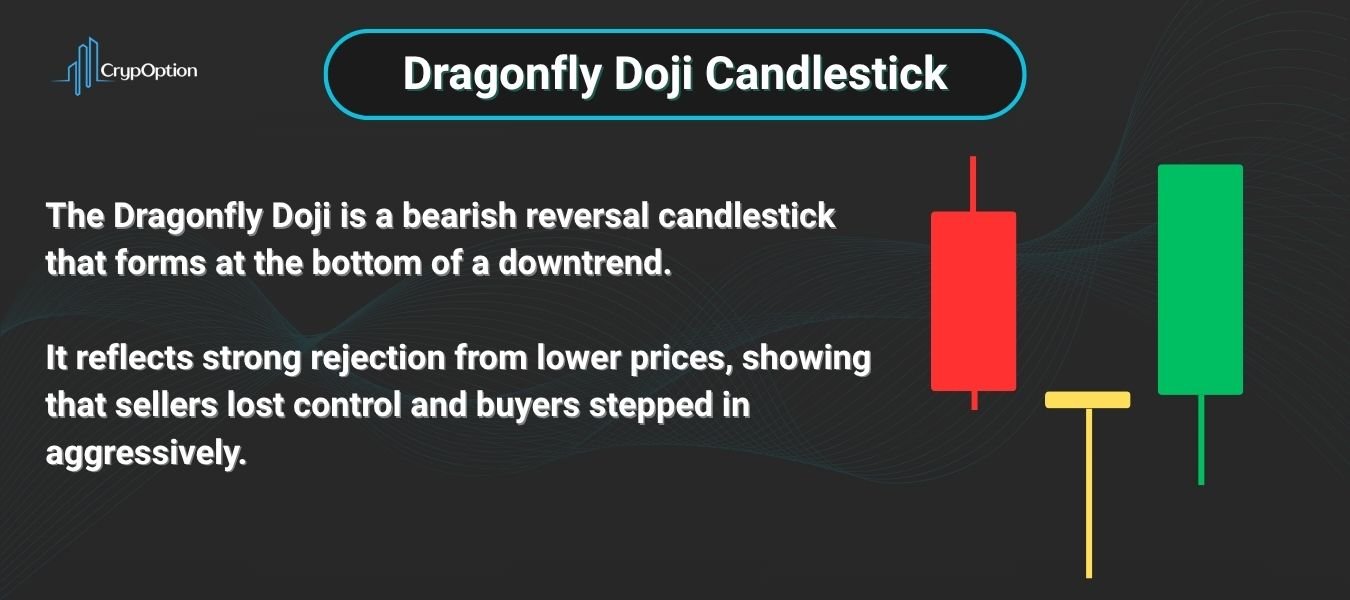

A Dragonfly Doji is a single candlestick pattern that shows strong rejection of lower prices. It forms when the open, close, and high of a candle are all at or very close to the same level.

What makes it unique is its shape. It looks like a capital “T”. There’s little to no upper wick, just a long lower shadow. That lower wick tells you sellers had control for most of the candle, pushing the price down. But by the end of the session, buyers stepped in and drove the price right back up to the opening level.

That kind of recovery isn’t just a bounce. It often signals a potential reversal, especially after a downtrend. The Dragonfly Doji is rare, but when it forms in the right spot, it can be a strong sign that momentum is shifting.

What Does the Dragonfly Doji Tell Us?

The Dragonfly Doji tells a story of rejection. Sellers tried to drive the price lower, and they succeeded, at least for a while. But by the close, buyers came in strong and erased all the losses, closing the candle where it opened. That kind of move shows buying strength.

It’s not just about price moving back up. The timing and aggression of the buyers are what matter. They took over before the candle closed and pushed the price all the way higher to the open. This is the power behind the Dragonfly Doji.

But then again, you can’t rely on this candlestick pattern on its own. You need more context. For example:

- If this pattern forms after a strong downtrend (ideally with oversold conditions), it could signal that sellers are running out of steam.

- If it appears at a key support zone, that bounce becomes more meaningful and likely the start of a new rally.

- If volume spikes during the formation, the signal gets even stronger.

So, on its own, a Dragonfly Doji isn’t a green light to buy. Without confirmation, it’s just a warning shot, and not a full reversal.

When Does a Dragonfly Doji Signal a Reversal?

The Dragonfly Doji signals a bullish reversal after a clear move down. It shows that sellers had control but failed to keep it. Buyers stepped in hard and pushed the price right back up by the close. That shift in control is what makes this pattern matter. But, as already mentioned, it only works when it forms in the right place. Without context, it’s just noise.

The Dragonfly Doji candlestick pattern becomes powerful when it shows up after a liquidity sweep, when the price grabs the stop losses below a key low and immediately rebounds. This is often where weak sellers get trapped, and smart money starts buying.

It also works well inside a bullish order block or demand zone. These are areas where institutional buyers are likely waiting. If price dips into that zone and leaves a Dragonfly behind, it’s a sign they’re active.

Another strong setup is when it forms inside a bullish fair value gap (FVG). The candle shows that buyers are defending the imbalance and want to push higher.

Even a simple support level, like a round number, previous low, or fib retracement, can make this pattern more meaningful. When the Dragonfly forms at a level where buyers have stepped in before, and especially when it’s paired with an oversold signal from momentum oscillators, you should be looking for buys.

So, there are lots of different ways you can use the Dragonfly Doji if you already have an overall strategy in place. It does what we all need, giving the confirmation for the beginning of a rally.

How to Trade the Dragonfly Doji Candlestick

Trading the Dragonfly Doji starts with one rule: never trade it alone. As I’ve already said multiple times, you need confirmation. Without it, you’re guessing.

Once the Dragonfly forms in a solid context, I mean after a downtrend, at a demand zone, inside a fair value gap, or after a liquidity sweep, wait for the next candle. If that next candle is bullish and closes above the Dragonfly’s high, you’ve got your green light.

That bullish close confirms buyers are in control. That’s when you can look for an entry.

The ideal entry is right after confirmation. Some traders wait for a small pullback into the body or wick of the Dragonfly before getting in, especially on lower timeframes. It gives a better price with tighter risk. But I personally like to get in sooner, because I already have context and market narrative on my side.

Stop-loss placement is also simple: just below the low of the Dragonfly. That’s the level the market rejected. If price breaks below it again, the setup has failed, and you want out. You can also give it more breathing room and set a wider stop loss if you prefer.

Now, the target depends on your strategy, but a clean structure break, a previous high, or an unmitigated FVG above can work well. Another method is a fixed R/R target, like a 1/2 or 1/3. You can also trail your stop as the price moves in your favor. I pretty much always trail my stop loss to breakeven after the market moves in my favor.

Dragonfly Doji vs Other Doji Types

Not all doji candles mean the same thing. The Dragonfly’s looks stand out because of its long lower wick and flat top. It’s a sign of strong rejection to the downside. But there are similar patterns you’ll often see, and it’s important not to mix them up.

| Pattern | Wick Direction | Trend Context | Signal Type | Key Difference |

|---|---|---|---|---|

| Dragonfly Doji | Long lower wick, no upper wick | After downtrend | Bullish reversal | Shows strong rejection of lower prices, buyers in control |

| Gravestone Doji | Long upper wick, no lower wick | After uptrend | Bearish reversal | Opposite shape; signals rejection of higher prices |

| Long-Legged Doji | Long upper and lower wicks | Any trend | Neutral / Indecision | Represents market indecision with wide price swings |

| Standard Doji | Short or no wicks | Any trend | Neutral | Open and close are equal with minimal price movement |

Dragonfly Doji for Binary Options Traders

For binary options traders, the Dragonfly Doji can be a powerful tool. That is, of course, if it’s used the right way. Since binary options are all about timing and precision, spotting a clean reversal setup can make the difference between a win and a loss. The Dragonfly pattern helps with that, but only when paired with strong confluence.

Yes, it can be useful for short-term trades, especially on the 1-minute to 5-minute binary options. When the price sweeps a low, taps into a demand zone, or enters a fair value gap, and then prints a Dragonfly Doji, you’ve got a strong signal that buyers are stepping in. This is the kind of setup that can give you a solid edge in short expiry trades.

For example, on a 5-minute chart, if price sweeps the low of the day, prints a Dragonfly at a demand zone, and the next candle pushes up, that’s a high-probability setup for a short-term CALL option. Just remember to set your expiry at least 2-3 times your timeframe, which in this case, is a 10-minute or a 15-minute expiry. I’m speaking based on experience on this one.

Conclusion

The Dragonfly Doji may look simple, but it tells a strong story: sellers tried and failed. When it shows up after a clear move down and aligns with key support levels, it often marks the start of a bullish shift.

But remember: context is everything. This pattern is only as powerful as the setup around it. Use it with proper confluence, like liquidity sweeps, demand zones, FVGs, and volume spikes. Wait for confirmation from the next candle. That’s how you turn a signal into a trade.

For binary options and short-term setups, the Dragonfly can offer sharp, accurate entries when the market gives you a clean rejection. Just don’t force it. The best Dragonflies are the ones that form exactly where buyers are expected to show up.

Stay patient. Let the setup come to you. And when the Dragonfly prints at the right time and place, don’t ignore it.