In this Autobot Signal Review, I’ll break down what this tool really is and what you should expect from it as a trader. I’ve seen a lot of “signal” tools sold to Pocket Option traders. Most of them sound perfect on the sales page. But in real trading, details matter.

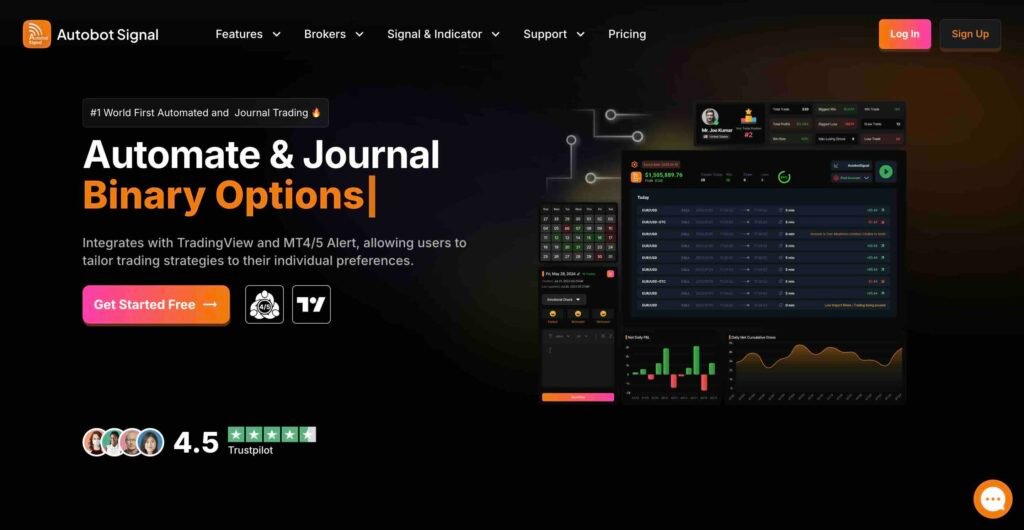

Autobot Signal is more of an auto-execution tool than a “magic signals” service. It can take alerts from places like TradingView and then place trades on supported brokers. Therefore, it is a tool worth analyzing for binary options traders.

- Autobot Signal is mainly an execution tool, not a “guaranteed signals” provider.

- The free plan is enough to test timing, expiry settings, and asset matching before paying.

- Your results depend on your strategy quality; automation can speed up losses if your alerts are weak.

- Pocket Option users should test live-market assets first, since OTC can be less stable for automation.

- Pick a plan based on your real daily trade count, not hype or “high win rate” promises.

What Is Autobot Signal?

Let’s begin this Autobot Signal review by introducing it and discussing how it works. Well, Autobot Signal is basically a bridge. It sits between your strategy and your broker. You don’t just “turn it on” and get profits. You have to feed it a real trading rule.

Most traders use it with TradingView. You build a setup and add an alert. Then, when the alert triggers, which means it has found a setup that fits your rules, Autobot Signal reads it and tries to place the trade on your broker account. It works the same with MT4 or MT5 if your system can send alerts.

Now, here’s the key point from my experience. The tool does not make decisions for you. It follows your instructions. So if your alerts are late or too frequent, the bot will still execute them. That’s why some people love it, and some people hate it.

Also, execution matters a lot in binary options trading. A few seconds can change the entry. And a bad entry can flip a win into a loss. That’s why you should test it on a Pocket Option demo account or any other broker’s demo account first. And you should keep your rules simple at the start.

If you plan to run it on Pocket Option, focus on normal market assets first. OTC can behave differently. The timing and price feed can be weird, and any automation tool can struggle there.

Autobot Signal Features

We should continue our Autobot Signal review by discussing its features. The tool is built around one core idea, which is to help you automate execution. So instead of watching charts all day and clicking fast, you let alerts do the trigger work.

Here are the main features most traders care about:

- Auto trade execution from alerts: This is the main selling point. You send an alert, and it can place the trade for you.

- TradingView and MetaTrader support: Many users connect TradingView alerts. Some also use MT4/MT5 systems.

- Daily trade limits based on your plan: The free plan is limited. Paid plans increase the number of alert trades you can send per day.

- Basic tracking and stats. Autobot Signal promotes tools like performance tracking and a trading journal. This is useful if you actually review your results, which you should.

Supported Brokers

Autobot Signal is often promoted for binary options brokers like Pocket Option, Deriv, Quotex, and IQ Option. It also supports other popular crypto and forex trading platforms. But here’s my honest view.

Now, no matter which broker you use, test the connection on a demo or small balance first. And start with the most liquid assets. You want clean execution before you trust it with real size.

One more thing. If the tool needs browser access, extension use, or login bridging, always think about safety. Don’t use random files from Telegram. And don’t give your main account access to anything you haven’t tested.

Autobot Signal Pricing

Autobot Signal keeps pricing simple. You either stay on the free plan, or you pay based on how many trades/alerts per day you want to run.

The free plan is $0 forever, but as I’ve mentioned earlier in this Autobot Signal review, it’s limited and comes with 10 trades or alerts per day. No credit card is also needed. That’s enough to test the tool and see if your setup works.

After that, you can choose between Essential, Plus, and Pro. Each level increases your daily limit. And you unlock a few extra perks like broker change, all-brokers license, and private group features.

| Plan | Monthly price | Yearly price (per month) | Trades/Alerts per day | What changes as you upgrade |

|---|---|---|---|---|

| Free | $0 | $0 | 10 | Basic access to test the system |

| Essential | $29/mo | $19/mo | 50 | Journal access, 1 broker license, support/helpdesk |

| Plus | $59/mo | $29/mo | 100 | Adds free broker change |

| Pro | $99/mo | $49/mo | 1000 | Adds all brokers’ licenses + create private group |

What Each Paid Plan Includes

All paid plans include the core stuff most traders want:

- Connect TradingView / MT4/5

- Copy trading from experts (they list this on all paid plans)

- Support & HelpDesk

- 1 broker license

- Free updates

- Access to the trading journal

The differences are important, though:

- Essential: Solid if you trade low frequency. But it does not include a free broker change.

- Plus: The sweet spot for many people. You get 100 trades/alerts per day and a free broker change.

- Pro: Only makes sense if you’re running heavy automation or managing multiple setups. It adds all-brokers license and private group features, plus the big 1000 daily limit.

Now, if you want my honest take, start with the Free plan first. Then move to Essential only if you’re sure you won’t overtrade, and if you’re serious and want more flexibility, Plus is usually the most balanced choice. Pro is, in my opinion, for power users, not normal binary options traders.

Autobot Signal Reviews: Pros and Cons

When you read Autobot Signal reviews online, you’ll notice two clear sides. Some traders like it because it saves time. They don’t need to stare at charts all day. They set alerts and let the tool execute. For disciplined traders, this can reduce emotional entries. It can also help you stay consistent with your rules.

Other traders dislike it because they expect “easy money.” And when they lose, they blame the tool. Some also complain about delays, asset mismatches, or problems in certain markets like OTC. In binary options, even a small delay can change the entry. So this part matters a lot.

To recap everything, here are the pros and cons I’ve encountered while reading Autobot Signal reviews online:

| Pros | Cons |

|---|---|

| Saves time by placing trades from your alerts | Results still depend on your strategy quality |

| Helps reduce emotional clicking and late entries | Small delays can ruin entries in binary options |

| Works with TradingView and MT4/MT5 alert setups | Setup can feel confusing for beginners |

| Paid plans add journal access and support tools | OTC and asset matching issues can happen on some brokers |

What You Should Consider for Pocket Option

This part of our Autobot Signal review is dedicated to those who want to use it on Pocket Option. My first tip is not to rush it. Test it like a trader, using the Pocket Option demo account. Then you can start with a very small account. Use one asset only, and pick a normal live market asset first, not OTC. Then run one simple alert rule for a full week.

Watch the entry timing. Check if the asset name matches. Check if the expiry is correct. And check if it ever skips trades or places the wrong direction. If execution looks clean, scale slowly. If execution is not clean, stop and fix it. In binary options, “almost correct” execution is still a problem. Because, well, it’s binary.

Conclusion

So, let’s finish our brief Autobot Signal review by answering the most important question: Is Autobot Signal worth it? Well, it can be useful, but only if you understand what it is. It’s not a magic signal provider. It’s an execution tool that follows your alerts. If your strategy is solid, it can save time and help you stay consistent. If your strategy is weak, it will just automate the losses.

For Pocket Option traders, the biggest deal is execution quality. You need clean asset matching, correct expiry settings, and stable timing. That’s why I always suggest starting with the free plan first and testing it on a demo or a small size.

So, if you want automation with discipline, Autobot Signal can make sense. But if you’re chasing fast wins and random signals, no bot will fix that.

FAQs

Do I need a PC, or can I run Autobot Signal on mobile?

Autobot Signal is promoted as a desktop software. Their site doesn’t clearly show an official mobile app download on the same level as the desktop installer.

Can I use Autobot Signal on more than one broker/account?

Their pricing page mentions “1 broker license” on paid plans. It does not clearly explain how many trading accounts you can run under that license. So the safest assumption is: one broker connection per license, unless their support confirms otherwise.

Can I set the trade amount and expiry time?

Yes, Autobot Signal shows these settings in its own examples. On their “Free Signal Key” page, they display Expiry Time (e.g., 1 min) and an Amount allowed per trade range. Also, a public promo video snippet describes an interface with amount and expiry fields.

What happens if the software closes or my internet drops?

Because Autobot Signal is positioned as desktop software, it needs to be running and connected to receive alerts and place trades. If it’s closed/offline, trades can be missed until it’s running again.

Is it “safe” to connect Autobot Signal to my broker account?

Autobot Signal is a third-party tool, and its public marketing focuses on automation, not security guarantees. The safest approach is to read their terms, use strong account security, and test with a small balance first.