Some links on this page are affiliate links. If you sign up or make a purchase through them, CrypOption Hub may earn a commission — at no extra cost to you. Learn more on our Disclaimers page.

Binary options are a type of financial derivative that allows traders to speculate on the price move of a certain asset during a short period. On the other hand, traditional options (vanilla options), also simply referred to as options, are a more mature and popular type of derivatives that provide the buyer with the right but now the obligation to trade an asset at a predetermined price, in a specific timeframe.

In this article, we’ll have a binary options vs options review, analyzing the differences and the commonalities between the two types of contracts and helping you decide which one is right for you to trade.

- Binary options offer a simple, short-term trading approach with fixed risk and reward.

- Traditional options (vanilla) provide more flexibility, strategy variety, and unlimited profit potential but require deeper knowledge.

- Both options types have limited downside risk for buyers, but profit structure and complexity differ.

- Choose based on your risk tolerance, trading style, and experience level.

What Are Options?

Let’s start our binary options vs options article by explaining what a traditional option is. In short, options are a type of financial contract that provides the buyer with the right but not the obligation to buy or sell a specific asset at a predetermined price and during (or at the end of) a particular time period.

| Element | Description |

|---|---|

| Underlying Asset | The financial instrument tied to the option, such as stocks, indices, ETFs, or commodities. |

| Strike Price | The price at which the option holder can buy (call) or sell (put) the underlying asset. |

| Expiration Date | The date on which the option contract expires; the holder must decide to exercise or let it expire. |

| Option Type | Call option (right to buy) or Put option (right to sell) contracts. |

| Option Premium | The cost paid upfront to purchase the option contract. |

| Intrinsic Value | The real, immediate value of the option if exercised now (difference between strike price and market price). |

| Time Value | The portion of the premium based on time left until expiration and market volatility. |

| Exercise Style | American (can exercise anytime before expiry) or European (can exercise only at expiry). |

Let’s make things clearer with an example. Suppose you’re looking at the XYZ stock, and you believe its share price will rise in the next months. In this case, if you want to have a clear risk profile and limited downside risk, you can buy a call option.

As the buyer of a call option, you will have to pay a price to purchase it, which is called the option premium. In our example, we assume that the option premium (price) is $5 per contract. Each contract is also based on one share of the XYZ stock, meaning that it will allow you to buy 1 share of XYZ per contract.

Now, suppose that XYZ shares are trading at $100 today, and you buy a call with the strike price of $110. The strike price is the price at which you will have the right to trade the underlying asset. Here, you will have the right to buy XYZ at $110 in the future.

Your option will also expire in 6 months, which means that it has a maturity of 6 months. Depending on the type of option, which can be European or American, you will be able to either exercise the call option only at maturity for the former case, or anytime from today until maturity for the latter.

Some other terms to be familiar with are related to the options “moneyness“. When your option is in profit, we call it in-the-money or ITM, and when it’s trading at a loss, we call it out-of-the-money or OTM. There’s also a third possibility for the option trade to be at breakeven, which is called at-the-money or ATM.

Options Risk-Reward Profile

Continuing with our example, suppose that you’re trading a European option. If at the time of maturity, XYZ is trading at, for example, $125, you will exercise your call and you can profit $15 per contract ($125 – $110 – $15). Yet, your total profit per contract will be $10, as you should also deduct the premium you’ve paid for each contract ($15 – $5).

On the other hand, if the XYZ stock is trading at $95 at maturity, your loss will be limited to only the premium you’ve paid, which is $5. The reason for this limited downside risk is that you’re not obligated to execute an option trade, and logically, you won’t do so if it’s not profitable.

The opposite is true for a scenario in which you forecast XYZ’s price will drop in the future. In this case, you can buy a put option, which will offer you the right but not the obligation to sell XYZ at a predetermined strike price and maturity.

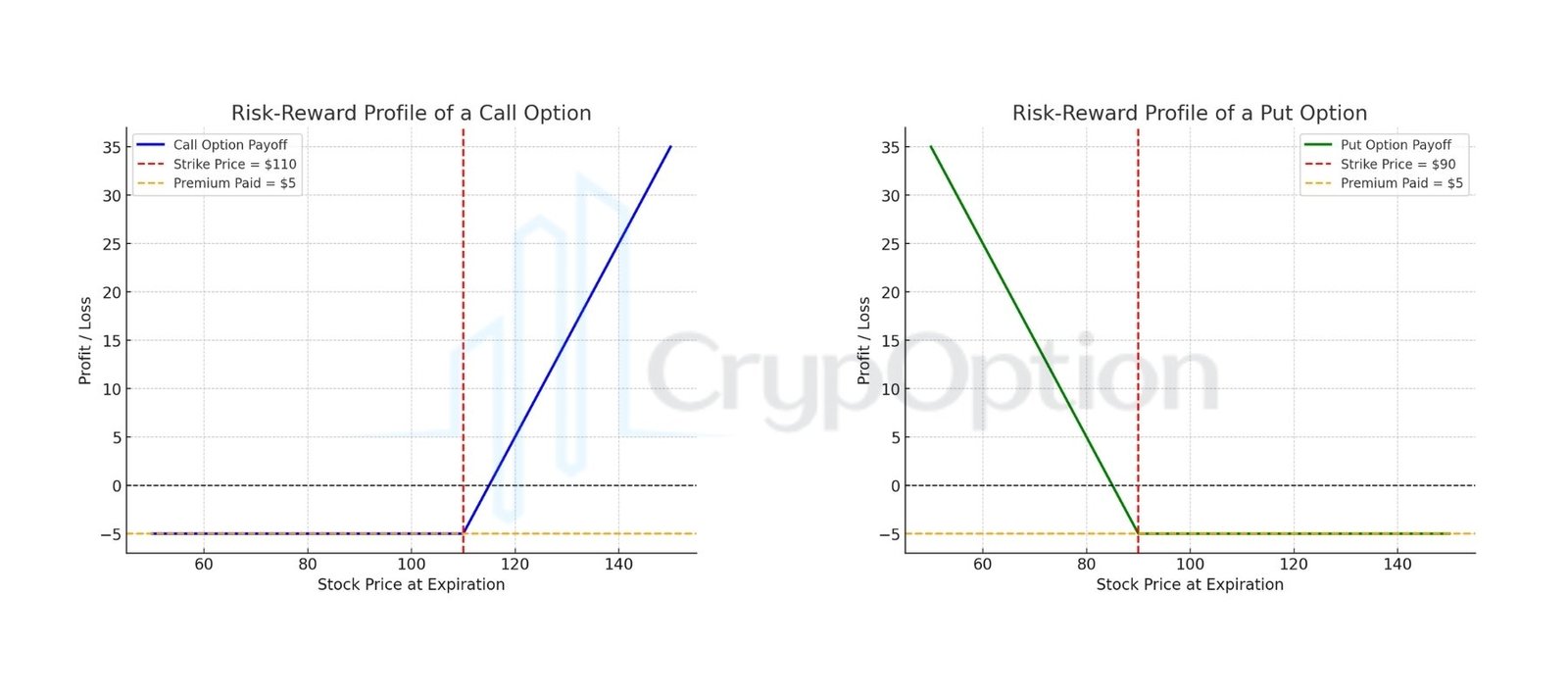

The image below shows a clear picture of the risk-reward profile for both put options and call options.

For a call option, the risk is limited to the downside, as you won’t care how much the price of the asset will plunge, but your profit will have no ceiling and will be relative to the magnitude of price appreciation.

On the other hand, things are exactly reversed for a put option, as your risk is limited against the price increase the asset experiences, and your profit will be relevant to the amount it depreciates. However, note that there’s actually a limit for put option profits, as the asset price cannot drop lower than zero.

Now you know about the concept of options trading, I suggest you take a look at our article about call spreads, which is a unique options trading strategy, where you can limit your risks and boost your outcomes!

What Are Binary Options?

Binary options are a newer type of derivative compared to traditional (vanilla) options. Imagine that once again, you’re analyzing the XYZ stock, but you believe that its share value will decrease in the next 30 minutes. In this case, you can execute a lower binary option (also called a put).

The same goes if you expect the price to rise, and you can invest in a higher binary option (also called a call). There are also other, less popular types of binary options which we will not discuss here.

Binary options also have some of the same elements as vanilla options. For instance, your maturity here is 30 minutes, which in binary options trading we call expiry. Also, your strike price will be the same as the price you executed your trade.

As for the premium, there’s an initial investment that you must make to purchase the binary option. Suppose that you invest $50in this trade. You can use different binary options platforms such as the Nadex, start with demo accounts, or trade with live trading accounts on different markets.

Binary Options Risk-Reward Profile

Now, if you execute the binary option at $100, and the stock is trading at $102 at the time of expiry, you will lose your initial investment, which we assume is $50. Therefore, your risk is limited to the amount you invest, just like traditional options.

On the other hand, if the price moves in your favor and XYZ’s share price is $97 at expiry, you will win the trade. But here’s where it gets different compared to vanilla options: Your profit will not depend on the magnitude of the price move in your favor, but on the payout ratio, which is usually around 80% of your initial investment. So, in case of a win, you will make around $40 in profit and get your $50 initial investment back.

Note that the exact payout ratio can be different among binary options brokers and even underlying assets. It can also change for the same asset and on the same broker during the day, due to varying volatility and liquidity.

The image below demonstrates the risk-reward profile of both higher and lower binary options. As you see, binary options traders don’t care how much the price is higher or lower than the strike price. The important thing is whether it is higher or lower, even by a tick. That’s why it’s called a “binary” option, as there are only two predetermined possible outcomes.

Moreover, it’s evident that in binary options trading, both your profit and loss are capped. Moreover, your risk-reward ratio in a binary options trade is always less than 1.

If you want to learn more, check out our free binary options beginner’s guide.

Binary Options vs Options: Head-to-Head Comparison

Now, let’s have an overall look and see how binary options compare to vanilla options. The table below demonstrates the general differences between Binary Options vs Options:

| Aspect | Binary Options | Traditional Options |

|---|---|---|

| Payout Structure | Fixed payout, all-or-nothing outcome | Variable profit based on asset price movement |

| Risk Level | Limited to initial investment | Limited to premium paid (buyer), potentially high (seller) |

| Profit Potential | Capped, typically 60%-90% of investment | Unlimited (calls) or substantial (puts) |

| Complexity | Simple, predict price direction | More complex, involves strike price, premiums, and multiple strategies |

| Expiration Time | Short-term, often minutes to hours | Flexible, can range from days to months |

| Regulation | Often loosely regulated | Strictly regulated on major exchanges |

| Underlying Assets | Forex, stocks, indices, crypto | Mainly stocks, indices, ETFs, commodities |

| Exercise Style | Automatic at expiration | American (anytime) or European (at expiration) |

Binary Options vs Options: Which One to Choose?

There are different pros and cons when it comes to trading binary options vs options (vanilla). So, the answer to the question above depends on your preferences. If you prefer simple, short-term trades with a clear, fixed outcome, binary options are the choice for you. You know upfront how much you stand to gain or lose. But remember, the risk is high, and profits are capped.

On the other hand, if you’re someone who wants more flexibility, better risk management, and unlimited profit potential, vanilla options are the better choice. Yes, they are more complex. You’ll need to understand strike prices, premiums, and different strategies. But they allow you to hedge, speculate, or take long-term positions based on your goals.

At the end of the day, it all comes down to your trading style and risk tolerance. If you’re a beginner, you may find binary options easier to grasp. Meanwhile, if you’re an experienced trader, you might prefer the versatility and control of traditional options.

Conclusion

Choosing between binary options vs options depends on your trading goals, experience, and risk appetite. Both of them offer unique advantages. For instance, binary options are more attractive for traders who like simplicity and quick results. That’s not the case for traditional (vanilla) options, as they are more complex but also offer much more flexibility, strategic depth, and most importantly, unlimited profit potential.

If you’re new to trading or want to practice without risking real money, I recommend testing your strategies first. You can try risk-free binary options trading today using the Pocket Option free demo account and see if it’s the right fit for you. There’s no commitment or no deposit.

If you prefer to practice on other platforms, check out the free binary options demo accounts.

FAQ

Are binary options riskier than traditional options?

Yes, binary options are typically considered riskier due to their all-or-nothing payout structure and shorter expiration times. Traditional options offer more flexibility in managing risk.

Can I trade both binary options and traditional options with the same broker?

Most brokers specialize in either binary options or traditional options. However, some platforms may offer both, though this is less common.

Do I need a lot of capital to start trading options?

No, binary options require lower initial capital (as little as $10 per trade), while traditional options might need more capital depending on the broker and the assets traded.

Is it possible to hedge using binary options?

Binary options are generally not used for hedging. Traditional options are better suited for hedging due to their customizable strike prices, expirations, and strategies.

Which is better for beginners: binary options or traditional options?

Binary options are easier to understand and trade for beginners, but come with higher risk. Traditional options require more knowledge but offer more control and flexibility.

CrypOption Hub contains affiliate links to various brokers and platforms. We may earn a commission if you choose to register or trade through these links. This is how we support our work and continue offering in-depth reviews, strategies, and trader-focused content. That said, we only promote services we have personally tested or trust. Trading binary options carries risk, and we encourage readers to trade responsibly. For full details, please read our Disclaimers page.