Thinking about trading binary options and stumbled across the Nadex platform?

Not sure if Nadex is legit or even the right fit for you? Don’t worry! This Nadex review has got you covered. I’ll honestly answer all your questions and clear up any doubts you might have about this platform.

So, let’s dive in and see what Nadex is all about!

- Nadex is a fully regulated U.S. exchange under the CFTC.

- Nadex offers three contract types: binary options, knock-outs, and call spreads.

- Demo accounts offer $10,000 virtual funds; live accounts start at $250.

- Funding is easy for both U.S. and non-U.S. users via card or wire transfer.

What Is Nadex? Platform Review & Basics

Nadex stands for North American Derivatives Exchange. It’s based in Chicago and is now part of the Crypto.com global brand. With Nadex, you can trade across multiple markets with over 10,000 contracts available: hourly, daily, and weekly, within five days a week on both desktop and the Nadex trading mobile app.

Think of Nadex as one of the few legal and fully transparent platforms in the U.S. offering three main types of contracts:

- Binary Options (the most popular)

- Knock-Outs

- Call Spreads

Keep scrolling, you’re diving into a full Nadex review that covers everything you need to know.

Nadex Review of the Platform’s Products

While reading different Nadex reviews online, I first came across their Products section, and I’ve got to say, it’s pretty solid. They offer three main products that let you trade in different markets, such as forex, indices, and more.

I’ll get into the full list of available markets a bit later in this Nadex review, but for now, let’s take a closer look at their core products and how they work.

Binary Options

Let’s kick things off with Binary Options contracts. As Nadex explains on their official site, trading a binary option is kind of like asking a simple question: Will this market be above this price at this time?

If you think the answer is yes, you buy. If you think no, you sell.

With Nadex Binary Options, you’re predicting how the market will move. At expiration, you either make a fixed profit or lose the amount you paid to enter the trade.

Each contract is priced between $0 and $10, and it clearly shows the maximum you can gain or lose. If your prediction is correct, you get a $10 payout. So your profit is $10 minus what you paid to open the trade.

If your trade doesn’t go your way, you don’t receive a payout, meaning you lose the initial amount you put in.

If you’re interested in binary options trading, you might also find our article about “Binary Options vs Options” helpful.

Knock-outs

Another exciting financial contract you’ll find in this Nadex review is Knock-outs, also known as Touch Bracket, which is actually exclusive to Nadex.

Here’s the deal: Knock-outs are all about deciding whether to buy (go long) or sell (go short) based on how you think the market will move. Each Knock-out contract is set between two key price levels:

- Floor: The lower limit. If the market hits this price, the contract is knocked out and expires instantly.

- Ceiling: The upper limit. Same idea: if the market reaches this price, the contract also expires right away.

To help you get a better feel for how it works, let’s walk through a quick example.

Imagine you’re trading the US 500 index, currently priced at 2720.00. You’re looking at a Knock-out contract with the following details:

- Floor: 2710.00

- Ceiling: 2760.00

Now let’s say you decide to buy. Here’s how your risk and reward would be:

- Maximum Risk: The difference between your entry price and the floor: 2720.00 – 2710.00 = 10 points. At $10 per point, your max risk is $100

- Maximum Profit: The difference between the ceiling and your entry price: 2760.00 – 2720.00 = 40 points. At $10 per point, your max profit is $400

If the market moves up and hits the ceiling price, you make the full $400. If it drops and hits the floor, you lose the $100 you risked. If neither level is hit, your profit or loss depends on where the market is when the contract expires.

Call Spreads

Just like the knock-outs we talked about earlier in the Nadex review, call spreads, also called Nadex spreads, are another feature that’s unique to Nadex. They let you trade on market moves without actually owning the asset. With call spreads, there’s a clear floor and ceiling, so you always know your max profit and max loss before jumping in. That’s pretty chill, yes?

But here’s the twist: unlike knock-outs, you can stay in it ‘til the end. Nadex spreads give the market more time to prove you right. So, if you think the market’s gonna move fast, you might pick a shorter contract, like one that ends in two hours. But if you expect a bigger shift over a longer time, you can go for a contract that lasts several hours or even days. Totally up to you. To learn more about this unique feature, you can read our article about Nadex Call Spreads, which is specifically about the top benefits of trading Nadex contracts.

| Features | Binary Options | Knock-outs | Call Spreads |

|---|---|---|---|

| Markets | Stock indices, forex, and commodities | Forex, US stock indices | Currencies, commodities, and stock index futures |

| Expiration Durations | Varies | Weekly | 2-hour, 5-hour, 8-hour, Daily, Weekly |

Nadex Review of Available Markets

In this Nadex Review, I covered everything from the platform itself to the different contract types: binary options, knock-outs, and call spreads. All of them let you trade market moves without actually owning the asset. But here’s the big question: what can you trade with these contracts?

Well, Nadex gives you access to various markets like forex, commodities, cryptocurrencies, and major stock indices. That means you’ve got options, no matter what kind of trader you are.

And the best part? Nadex has solid educational resources to help you learn about each market and boost your skills. So if you’re just starting out or wanna sharpen your strategy, you’re totally covered.

Nadex Review of Fees (Pricing)

When it comes to Nadex fees, they keep things pretty straightforward, but it does depend on which type of contract you’re trading: binary options, knock-outs, or call spreads.

If you’re trading binary options, Nadex charges $0.10 per contract when you enter or exit a trade before expiration. If you hold the trade until expiration, there’s another $0.10 fee.

For knock-outs and call spreads, Nadex fees are a bit higher. You’ll pay $1 per contract to enter or exit a trade before it expires, and another $1 if the trade goes all the way to expiration.

So yeah, the type of contract you choose affects the cost, but at least you always know what you’re dealing with upfront. No hidden surprises.

| Type | Binary Options Contracts | Knock-out and Call Spreads Contracts |

|---|---|---|

| Entry or exit before expiration | $0.10 trading fee per contract | $1 trading fee per contract |

| Trade expiration (in-the-money) | $0.10 settlement fee per contract | $1 settlement fee per contract |

| Trade expiration (out-of-the-money) | No settlement fee | – |

Nadex Demo and Live Accounts Review

We hope this Nadex review has helped you get a clear picture of how Nadex works and what makes it stand out. If you feel like Nadex fits your trading style, you can start trading binary options, knock-outs, or call spreads anytime, from anywhere.

You’ve got two ways to get started: create a live trading account or take your time and practice with a Nadex demo account first.

Nadex Demo Accounts Review

With a Nadex demo account, you’ll get $10,000 in virtual funds to test out your strategies in real market conditions. You can try trading forex, commodities, and stock indices without risking real money. After reading this Nadex review, you can open your demo account and test different technical indicators such as the Aroon indicator, the Zigzag indicator, and the Vortex indicator, which really help you build up your trading strategy.

Nadex Live Trading Accounts Review

Once you’ve got some confidence with the Nadex demo account, you can move on to a Nadex live trading account. Nadex’s minimum deposit is just $250, and the platform keeps things transparent with clearly defined fees for trading and settlement.

Nadex Fundings (Deposit and Withdraw Funds)

As I’ve already mentioned at the beginning of this Nadex review, Nadex is a U.S.-based exchange that specializes in short-term derivatives like binary options, knock-outs, and call spreads. Since it’s designed primarily for U.S. traders, the deposit and withdrawal process works a little differently for U.S. residents and non-U.S. residents.

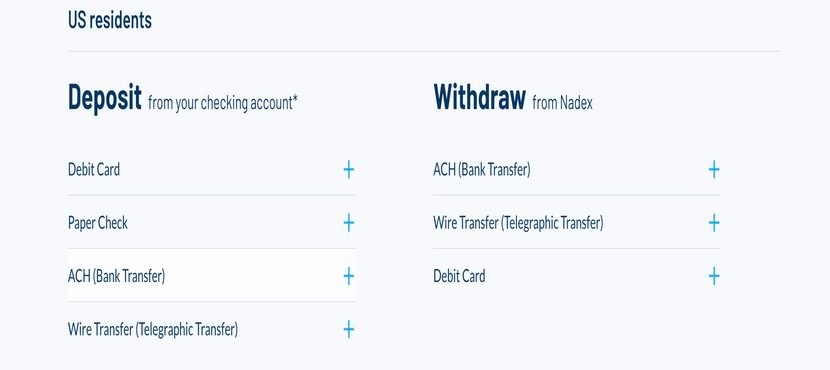

US-Based Resident

If you’re a U.S. resident, you can deposit funds using several methods, like debit cards, paper check, ACH, and wire transfer. For withdrawals, you can also use a debit card, ACH, or wire transfer, super convenient and fast.

To withdraw your money, you can also use the Debit card, ACH, and wire transfer.

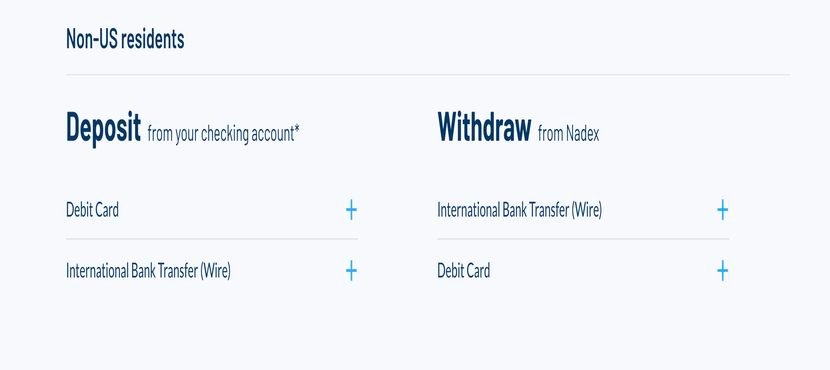

Non-US Residents

If you’re outside the U.S., no worries! You can still deposit and withdraw using reliable options like your debit card or a wire transfer.

And don’t forget: whether you’re in the U.S. or not, the Nadex minimum deposit is $250.

Is Nadex Legit? (Nadex Regulation Review)

One of the most common questions traders have is about regulation, and here’s the good news: Nadex is regulated by the CFTC (Commodity Futures Trading Commission).

That means Nadex is one of the few legal binary options platforms available to both U.S. and non-U.S. traders. This is a key point often emphasized in any detailed Nadex review, as regulation ensures the platform follows strict financial rules, ethical standards, and offers legal protection if something goes wrong.

In short, the CFTC acts as a watchdog for the U.S. derivatives market, making sure Nadex stays legit, secure, and transparent.

Nadex Robots Review

When you search for a Nadex review, you might also come across some terms like Nadex robots, Nadex signals, or Nadex APIs. It’s important to understand that Nadex itself doesn’t create or provide any trading signals, automated robots, or trade recommendations.

That said, there are third-party tools and services out there, some even using the name “Nadex,” like one called Nadex Robot that I read about on GitHub. But these are not officially affiliated with Nadex.

If you decide to use such tools, it’s your responsibility to make sure they comply with Nadex’s rules. They may help you develop trading strategies or ideas, but they’re not connected to Nadex in any way. Also, sharing your Nadex login with these services could violate Nadex’s policies unless you have their approval.

Nadex Trading App Review

You can trade on Nadex using both desktop and mobile devices. The Nadex trading app, called NadexGo, offers a smooth and user-friendly experience for mobile users.

With the Nadex app, you can easily access your demo or live account, browse available markets, and choose your contract, all with just a few taps. Whether you’re trading binary options or knock-outs, NadexGo lets you stay active in the markets while managing your other daily tasks.

Conclusion

Well, that’s all about my findings on the Nadex platform. I hope this Nadex review has given you a clear and helpful overview, so you can decide whether it fits your trading needs.

For more reviews on trading apps and the latest updates on Nadex, stay connected with us at Crypoptionhub.com.

What is the minimum deposit for Nadex?

The minimum deposit for a real Nadex account is $250, while no deposit is required for a demo account.

Who regulates Nadex?

The Nadex platform is regulated by the CFTC (Commodity Futures Trading Commission).

Does Nadex accept US clients?

Nadex is one of the most reliable binary options trading platforms based in the U.S. For U.S. residents, it stands out as one of the best choices available.