Pocket Option Overview

Most people lose on Pocket Option for the same reason. Not because the broker is rigged, or even because they picked the wrong indicator. They lose because they trade like they’re playing a game or simply gambling, not running a plan. One random click turns into two. One loss turns into a quick recovery trade. Then the expiry gets shorter, the stake gets bigger, and the chart becomes noise. That’s how accounts bleed out. Fast.

This guide is different. These Pocket Option trading tips are for those of you who are real traders. And the goal, well, is making trading decisions repeatable. Keep risk small. Stop the emotional spirals that wipe beginners. And build a process that works in both demo and live conditions.

- Keep one asset and one entry timeframe for consistency.

- Set a default expiry and do not change it trade to trade.

- Use demo accounts for testing, not casual practice. Aim for 50–100 trades with the same rules.

- Use minimal indicators. One trend filter is enough at the start.

- Fix stake size from the start. Random sizing ruins the data and the mindset.

- Use a 10-second checklist before every trade to avoid boredom and revenge entries.

The 3 Rules That Matter Most

If your Pocket Option account blows up quickly, it’s almost never because the setup was bad. It’s because the risk was unmanaged. Binary options punish emotional sizing. I mean, if you have just one losing streak and make the stakes bigger, it can erase weeks of your progress. Let’s start our Pocket Option trading tips with three base rules that stop this from happening.

1. Use Fixed Position Sizing

Always pick a position size that is small enough to survive a rough day. The moment the size changes because of emotion, the results stop meaning anything. I mean, your Pocket Option trading strategies might be fine, but the sizing turns the results into chaos. This is one of the most important pocket option trading tips for success, because it protects both the account and the mindset.

2. Set a Daily Loss Limit and Respect it

Every profitable trader has a stop. I always like to consider two simple options:

- Max loss per day: Stop after losing a fixed amount.

- Max losing trades per day: Stop after 2–3 losses.

If you follow this rule, you’ll definitely stop the classic spiral of loss, frustration, emotional entries, bigger position size, and account wipeout.

3. Cap the Number of Trades per Session

Now, if you’ve seen the Pocket Option platform, you’d know that it makes it easy to overtrade. That’s why you need to adhere to this rule, even before a losing streak happens.

I suggest setting a maximum number of trades per session, like:

- 3–5 trades per session for beginners

- Or 1–2 A+ trades if the goal is quality

Remember this crucial fact: more trades don’t mean more money. It usually means more mistakes and a higher risk of ruin.

Pocket Option Tips and Tricks for Entries

After years of trading, I’ve come to the realization that most bad trades start with one thought, and that is fear of missing out when the market starts to move. I want you to make your entries boring and systematic. Boring is good because it makes it repeatable. Below are 4 practical Pocket Option trading tips for entries.

1. Trade with the Directional Bias, Not Against it

Before looking for an entry, decide the bias in one quick step. If the price is generally making higher highs and higher lows, focus on call/higher setups. And if the price is generally making lower highs and lower lows, focus on put/lower setups. This will remove a lot of random clicking.

2. Use Obvious Levels, not the Perfect Ones

Beginners love precision. This usually leads to perfectionism in trading, which is not a good characteristic. The market almost repeats the exact setup you have in your notebook.

So, use reference levels that are easy to see. These can be recent swing highs and lows, clear support or resistance zones, and strong rejection areas where the price reacted decisively in the past. Then wait for the price to return to that zone. If the market is in the middle of nowhere, walk away from the charts.

3. Wait for Confirmation

A clean way to avoid fake moves is getting a simple confirmation. Here are two simple examples:

- At support levels: Wait for a bullish reversal candle like a Hammer candlestick pattern.

- At resistance levels: Wait for a bearish reversal candle like a Shooting Star candle.

I consider this one of the most useful Pocket Option tips and tricks because it forces patience without overcomplicating things.

4. Avoid Choppy Ranges

As a trader, you want to see the price move with a clear intent. If the price is moving sideways with small candles and no clear direction, it’s usually a liquidity trap.

I recommend that you apply a simple filter. If the last 10-20 candles look messy and overlapping, then skip that trading session.

Expiry Time Selection

A clean entry can still lose if the expiry makes no sense. This is why so many Pocket Option trading tips that focus on price action only feel useless in reality. The simplest way to fix this is to match or use a small ratio between expiry and the timeframe you use for the entry. Here’s a practical rule that works quite well for most beginners:

- If your entries are based on M1, expiry should usually be short (between 1-10 minutes), because the move is expected to play out fast.

- If your entries are based on M5, expiry should be longer (between 5-60 minutes), because the move needs time to develop.

The mistake is mixing them. For example, you might use an M5 setup and then choose a very short expiry, like 1 minute, because you want a quick result. So, I always ask myself a simple question: How many candles should it take for this move to play out if I’m right? The answer is your trade expiry.

Also, make sure to avoid short expiries during news releases and the first 5-10 minutes of a new session (like London or New York open). Because in those moments, the price can flip both directions in a matter of seconds.

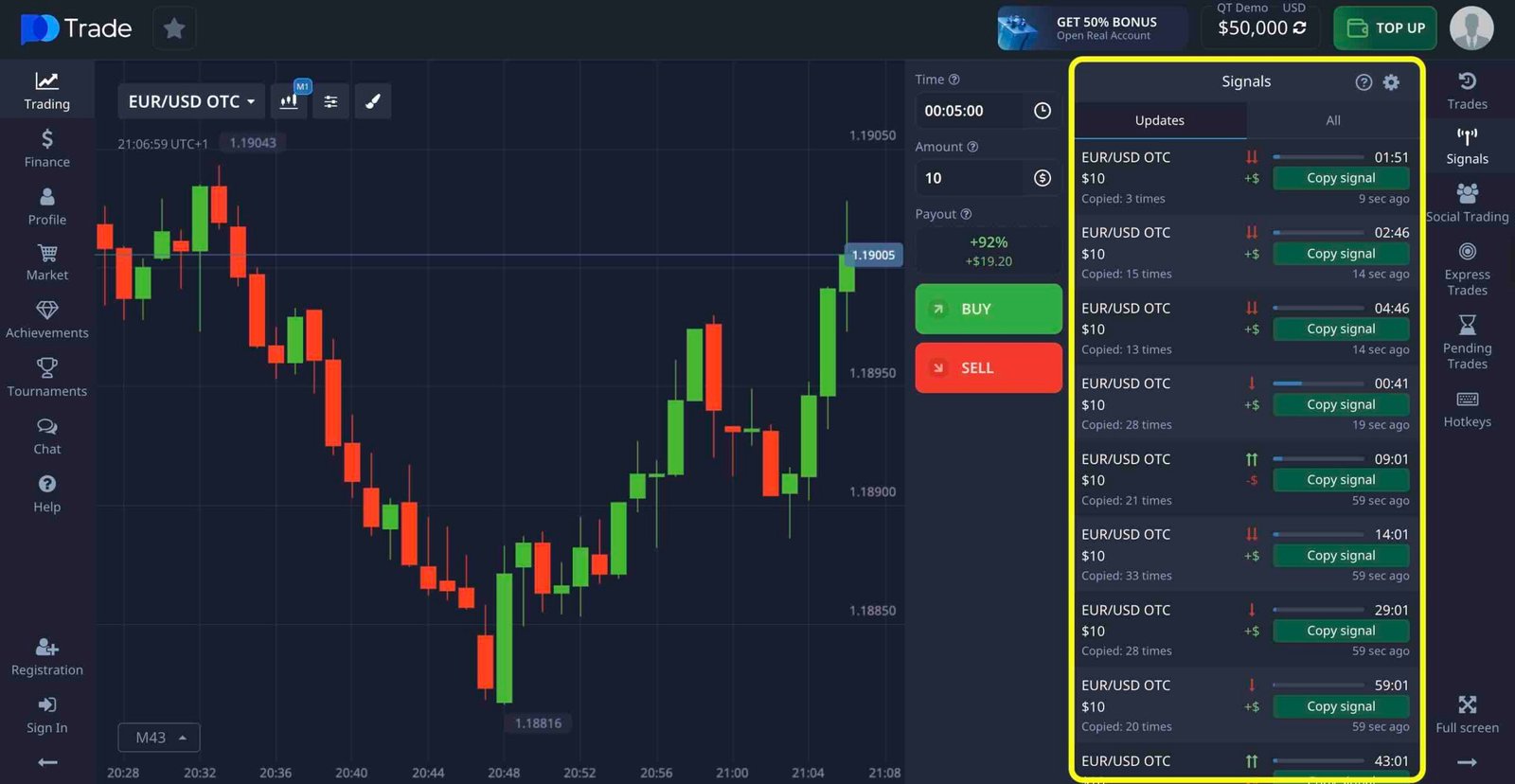

Tips to use Pocket Option Signals

The free Pocket Option signals can be useful if you treat them as a hint or simply an additional confluence. Most beginners do the opposite. I mean, when they see a signal, they click instantly, and then blame the platform when it loses.

Let me rephrase my proposition. The smarter way is to use signals as a filter. That’s the right way to use it. So, never take a signal in the middle of nowhere. These alerts are most dangerous when the price is floating in a random area.

Instead, I suggest you only consider signals where the price is either testing a clear level, getting rejected from a zone, or moving with a clear direction. If none of that is true, just skip it. And always confirm the direction with your bias and your own strategy.

Extra Pocket Option Live Trading Tips for Beginners

Live trading is just different. That’s because you have real skin in the game. So, the same setup that looked easy on your Pocket Option demo account suddenly looks stressful as real money is on the line. Here are a few Pocket Option live trading tips for beginners, so that you can avoid the issues associated with trading real money:

1. Start Smaller than You Think You Should

When your stake feels meaningful, your emotions get louder. And when emotions get loud, you’ll break the rules. A good beginner approach I suggest is to start with a position size so small that a loss feels like data instead of pain. First, protect your decision-making quality. Profits will come later.

2. Reduce Variables to Avoid Confusion

Most beginners trying binary options trading fail because they change too many things at once. If you want to have a clean learning phase, lock these variables:

- One asset

- One session (same hours each day)

- One entry style

- One expiry approach

This way, your trading becomes a repeatable process. That’s the foundation behind Pocket Option trading tips for success.

3. One Setup, One Sample Size

Never judge a strategy after 10 trades. Not when trading withreal money, and not even when you’re forward testing strategies. That’s a small sample size that can involve lots of noise and outliers.

The approach I recommend is to take 50–100 trades, then review the data. If it’s losing, fix one thing you think is wrong, and test again. And if the strategy is actually working, do not upgrade it too early. Most traders ruin a working edge by tweaking it out of boredom or ambition.

4. Avoid Revenge Trading

Revenge trading, or trying to make your losses back quickly, is the fastest way to destroy an account. So, after a loss, take a short pause. Even 2 minutes is enough to reset. Make sure yournext trade idea is not driven by anger, speed, or urgency.

5. Use a Live Trading Routine

Having a routine is one of the most practical Pocket Option trading tips I can give you. This should be the boring routine that keeps your account alive. Here’s a sample routine based on what I personally do:

| Phase | Step | What to Do | Time Guide | Rules |

|---|---|---|---|---|

| Before session | 1 | Set the environment: 1 asset + 1 entry timeframe + fixed stake | 2 min | No switching assets/timeframes mid-session |

| Before session | 2 | Define bias: only look for trades in the main direction | 2–3 min | No counter-trend trades |

| Before session | 3 | Mark 2–3 key levels: obvious support/resistance + latest swing high/low | 5 min | If levels aren’t clear, skip the session |

| Before session | 4 | Set limits: max trades + stop limit (example: 5 trades or stop after 2 losses) | 1 min | Stop means stop |

| During session | 5 | Wait for price to hit your level: no mid-chart entries | Ongoing | No boredom trades |

| During session | 6 | Entry rule: confirmation candle at a clear level | 10–20 sec | No confirmation = no trade |

| During session | 7 | Expiry rule: match expiry to the entry timeframe / expected move speed | 10 sec | No random expiry changes |

| During + after | 8 | Log and review fast: 1-line note per trade, then 5-min review after session | 5–7 min | Improve one thing at a time |

Conclusion

Binary options trading on Pocket Option rewards traders who treat it like a process, or even a money management business, and not a casino. If there’s one thing to take from these Pocket Option trading tips, it’s that consistency always beats intensity.

If you want real progress, stop chasing quick wins and start stacking clean execution. Trade less, track everything, and review weekly. That’s how these Pocket Option trading tips for success turn into actual results in live conditions.

FAQs

How to win easily on Pocket Option?

There is no easy win. The closest thing is trading fewer, high-quality setups with fixed risk, a daily stop limit, and consistent rules.

What is the 3 5 7 rule in trading?

It usually means risk control limits: risk about 3% per trade, stop after around 5% daily drawdown, and cap total exposure around 7% (some traders use slightly different versions).

Why do 90% of binary options traders lose money?

Because most people overtrade, change expiry and stake size emotionally, chase losses (martingale/revenge trading), and trade without a tested edge or sample size.

CrypOption Hub contains affiliate links to various brokers and platforms. We may earn a commission if you choose to register or trade through these links. This is how we support our work and continue offering in-depth reviews, strategies, and trader-focused content. That said, we only promote services we have personally tested or trust. Trading binary options carries risk, and we encourage readers to trade responsibly. For full details, please read our Disclaimers page.