Note that the brokers mentioned in this page are affiliates of CrypOption Hub, as this is our way of financially supporting our webpage and continuing to provide useful, informational content. For more details, visit our Disclaimers page.

You might’ve tried trading futures or CFDs but have failed miserably. Well, you are now alone. A possible solution for you might be to try other financial instruments, like binary options. The primary reason that binary options trading might be the way to go for you is that it’s much less complicated.

In this article, I will explain what these instruments are in detail. Then, I’ll clarify how they work with real examples. So, if you need a full beginner’s guide to binary options trading, make sure to read this article carefully.

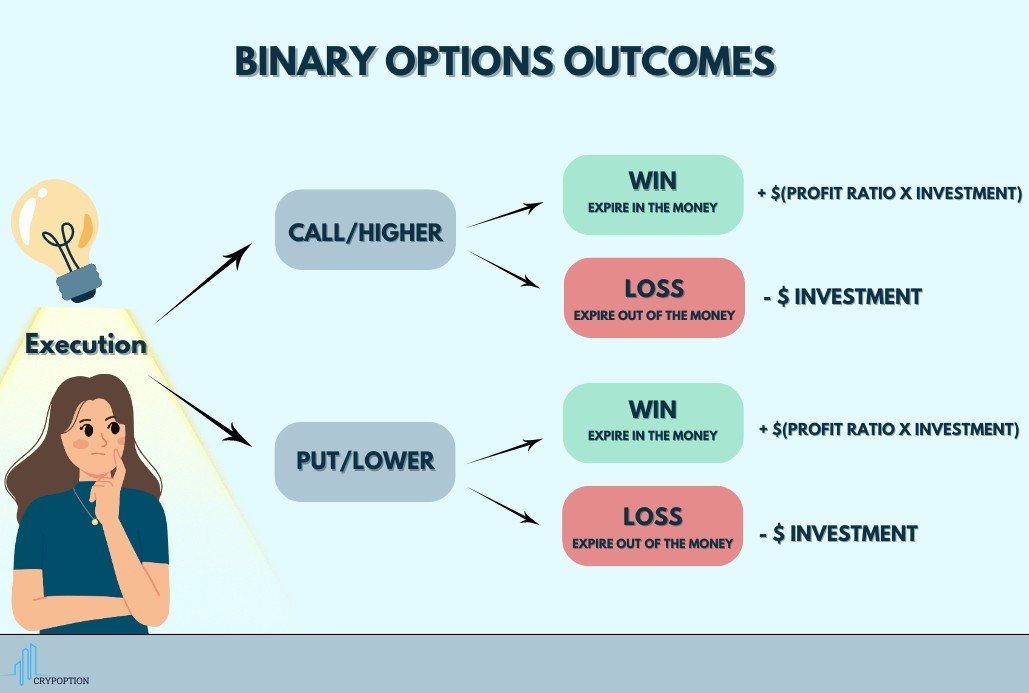

• Binary options are simple financial derivatives that allow you to speculate on whether the price of an asset will rise or fall in a specified timeframe.

• Call options predict a price increase, while put options predict a price decrease.

• Binary options have a fixed risk and reward structure, meaning you know your potential profit or loss upfront.

• Although binary options are easy to understand, they come with high risk due to all-or-nothing outcomes and the need for a high win rate.

• Choosing a reliable broker is crucial, as many binary options platforms lack proper regulation.

What Are Binary Options?

Binary options are a relatively new financial instrument. There is a simple concept behind these instruments: will the price rise or fall in a specified period? The answer to this question will determine the result of your binary trade.

Let’s start from the basics. Binary options are derivatives. By definition, derivatives derive their value from their underlying asset. So, trading a derivative based on a certain asset does not mean that you own it. You will just earn or lose a certain amount of money as the price of the underlying asset rises or falls.

Read More: Are Binary Options Scam, or Just Unfairly Infamous?

The term “binary” reflects two possible choices. You should decide whether the price of the underlying asset will increase or decline in a certain timeframe. Now, if you are correct about the direction at the time of expiry, your option will expire in the money. This means that you will win a specific amount of money. On the other hand, if the binary option expires out of the money, you will lose your investment.

This is a rather straightforward method for trading. You should only decide whether the price will be higher or lower than your entry price when the option expires. Unlike trading CFDs, you will not have to worry about setting the correct stop-loss or take-profit orders. This simplicity makes binary options trading attractive for traders of all skill levels.

However, do not let the term “simple” fool you. Binary trading, similar to any other type of trading, involves risk factors. You can still lose money, even all of it. So, there will still be a lot of learning to do. But don’t worry; we will help you start on the right foot with this guide.

If you don’t fully understand the differences between binary and vanilla (traditional) options, check out this comprehensive binary options vs vanilla options comparison.

Elements of a Binary Option

You might’ve already picked up the primary elements of a binary option contract. If not, let me explain. But first, let’s see the two main types of any option, including binaries:

- Call Option: A call binary option predicts the price of the underlying asset to be higher than the entry price at expiration.

- Put Option: A put binary option predicts the price of the underlying asset to be lower than the entry price upon expiry.

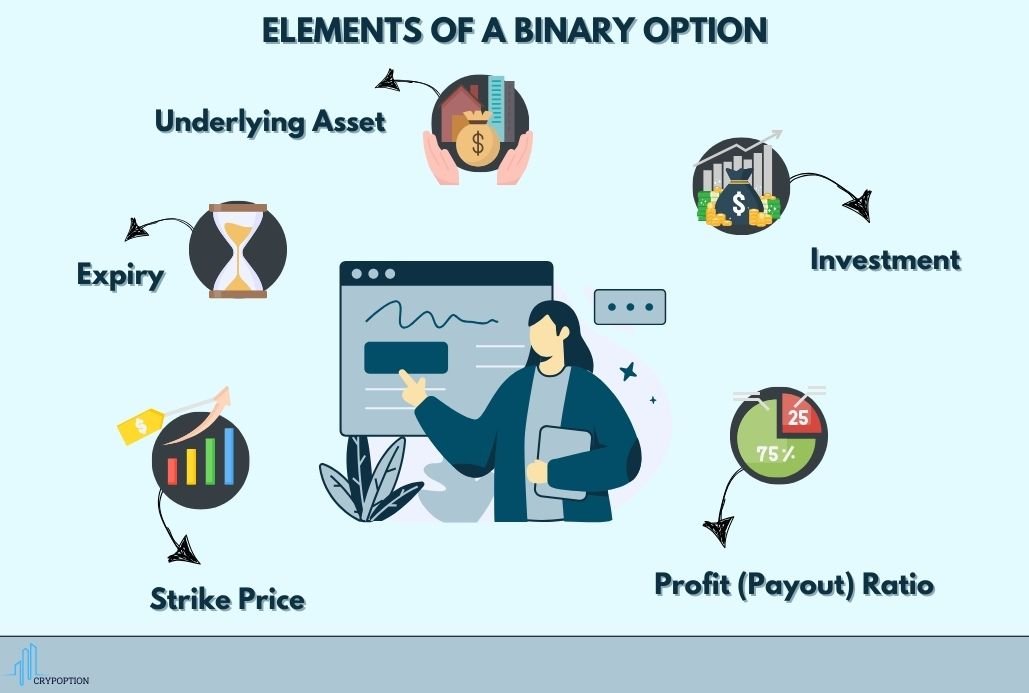

Now, let’s analyze the primary elements of any binary option contract:

- Underlying Asset: As already explained, binary options are derivatives based on a certain asset. So, the first element you should determine is the underlying asset.

- Expiry: The expiry time of a binary contract is when the position will be closed, either in profit or loss. The expiration is typically set by the trader.

- Strike Price: The strike price is usually the entry price. It essentially is the price that you think the market will be below or above it at the time of expiry.

- Investment: The initial investment you make in a trade is the amount of money you risk. If you are wrong, you will lose the whole amount.

- Profit (Payout) Ratio: The amount of money you earn in a winning binary options trade is a predetermined fraction of your investment. This fraction, often presented in percentages, is called the profit ratio or payout rate.

How Do Binary Options Work (Real Example)?

Now that you have a basic understanding of the definition and principles of these options, let me make things even clearer with an example.

Imagine you are a binary trader who believes that the ABC stock price will increase over the next hour. You decide to invest $100 in a binary call option. If, at the end of the hour, the stock price is higher than the initial value, you will receive a predetermined payout of 80%, resulting in a profit of $80 (80% of $100).

On the other hand, if ABC’s price is lower or unchanged at the expiration time, you will lose the entire $100 invested in the binary option.

As you can see, the outcome is binary, meaning that you either win a predetermined, fixed amount of money or lose your investment. As a result, you will always have a clear risk/reward ratio when trading binary options.

Read More: How to Choose a Binary Options Broker?

Advantages and Disadvantages of Binary Options Trading

Just like any other trading instrument, binary options trading also involves multiple advantages and disadvantages. In this section, we analyze the primary pros and cons of trading these instruments.

Pros of Trading Binary Options

Binary trading offers several potential advantages. Here are some of the key pros:

- Simplicity: Binary options trading is known for its simplicity. You only need to predict whether the price of an asset will go up or down within a specified time frame. This straightforward approach eliminates the complexity of traditional trading instruments. To do so, you can use various technical tools such as the Vortex Indicator, DMI Indicator, ZigZag, RSI, etc.

- Defined Risk and Reward: They have a fixed payout structure. You will know the potential profit or loss before entering a trade. This characteristic provides clarity and allows for better risk management.

- Quick Results: Binary options often have short expiration times, ranging from seconds to days. This feature allows traders to see the results of their trades quickly. For those who prefer fast-paced trading, binary trading offers rapid outcomes and the potential for quick profits.

- No Ownership of Assets: Unlike traditional trading, in which investors own the underlying assets, binary options trading does not involve ownership. They are considered derivatives that allow you to speculate on price movements without actually buying or selling the assets. This simplifies the trading process and reduces the complexities of ownership.

Read More: Are Binary Options Legal in India?

Cons and Risks Associated with Binary Options Trading

Trading binary options is not all fun and games. It comes with certain risks and disadvantages that you should be aware of. Below are some of the disadvantages and risks:

- Low Reward/Risk Ratios: Binary options trading involves a low reward/risk ratio. If your prediction is incorrect, you can lose the entire investment amount. On the other hand, if you correctly anticipate the price movement, you will usually earn a profit less than your initial investment. Therefore, your reward/risk ratio is typically less than 1.

- Limited Regulatory Oversight: In recent years, this industry has faced multiple challenges related to regulatory bodies. While some reputable brokers operate in this space, others may be less trustworthy.

- Broker Dependency: Your trading experience heavily depends on the binary options trading platform and broker you choose. Some brokers may have unfavorable terms and conditions or lack transparency. Also, some trading platforms might be less user-friendly and offer few useful features. So, remember to choose wisely.

- Lack of Ownership Benefits: In the traditional stock market, trading and investing, holding a company’s share will yield dividends. However, binary options are derivatives that do not lead to ownership of the underlying asset. This is also considered a drawback because you will not receive potential benefits like dividends.

- Fixed Payouts Regardless of Market Conditions In binary trading, the amount of profit for every trade is fixed. Therefore, regardless of the extent of the asset’s price movement, you will earn a fixed amount of money if you are correct. Obviously, this can be a disadvantage in a volatile market.

Are Binary Options High Risk?

Just like any other form of trading in the financial markets, binary options trading is also risky. Yet, I should emphasize that there are some specific risk factors for binary trading. For instance, the fact that they are mostly short-term derivatives available for intraday trading introduces the risk of overtrading.

Moreover, they are mostly all-or-nothing contracts with reward/risk ratios below one. So, you would definitely need a high winrate binary options strategy and significant psychological endurance to be profitable. Make sure to test your strategy on a binary options demo account before getting into real trading.

Are Binary Options Illegal?

Most binary options brokers are unregulated. This makes binary options trading illegal in some countries. However, using reputable brokers can significantly reduce the risk of fraud. Therefore, make sure to fund the right broker first. If you’re not sure which broker to choose, CrypOption Hub is here to help you decide.

Getting Started with Binary Options Trading

In order to begin your binary trading journey, you should first select a binary options broker. I suggest going for the most popular ones like Pocket Option, Quotex, or IQ Option. Also, note that some of these platforms require VPNs for access from certain locations. Check out our video on how to download free VPNs for binary options trading.

You can trade cash or nothing higher/lower (call/put) options on this platform. To open a trade, you simply need to decide whether the price will be higher or lower than the open price when the expiration time arrives. This, of course, heavily depends on your binary options strategy.

Here is an example of 2 call options with expiration at 11:50 AM and a volume of $100 each ($200 total investment) on the US Dollar / Japanese Yen forex pair.

As the picture depicts, you have opened your call position at the 143.40200 price mark. Now, there are three possible scenarios:

1. If the option expires below the open price, you will lose your whole investment of $200.

2. If the current price is higher than the open price at 11:50 AM but still inside the specified range, your loss will be a percentage fraction of your investment. For example, if the option expiry reaches when the price is at the point indicated with -39%, you will lose $78 (-39% of $200).

3. Finally, if the price is above the specific price range at expiry, you will receive the percentage on the right side of the chart multiplied by your total investments as profit. For instance, if the price expires at the point shown as +51%, you will gain 51% of $200, which is $102.

Note that if you sell your option at any time before expiry, you will lose your initial investment of $200. Things are similar for a put option. The image below demonstrates a put option with an investment of $100 at the same expiration time, 11:50 AM. The scenarios are the same as those for the call option described above.

Read More: One of the useful technical tools that helps you trade binary options is the “Aroon indicator“. Personally, I found this tool very useful, and that’s why I suggest it to you too.

Conclusion

Binary options are considered one of the financial innovations of recent years. These derivatives simplify the trading process for many traders by clearly demonstrating each trade’s reward/risk profile. However, trading these instruments also has its drawbacks and risks. So, remember to educate yourself before jumping into binary options trading.

Read More: How to Trade Binary Options using Fair Value Gaps?

FAQ

What are binary options?

Binary options are financial derivatives where traders predict if the price of an asset will rise or fall within a specific timeframe, leading to either a fixed profit or loss.

How do binary options work?

Binary options traders choose whether the price of an asset will be higher or lower than the entry price at expiry, and if correct, they receive a fixed payout; if incorrect, they lose their investment.

Are binary options illegal?

Binary options are illegal in some countries due to limited regulatory oversight, but using a reputable broker can reduce risks.

Is binary options a gamble?

Yes and no. Trading without a binary options strategy can be considered a gamble due to the all-or-nothing nature of the trades and their dependence on short-term market movements. Otherwise, it is not gambling.

Is binary options a good idea?

Binary options can be profitable but are risky due to low reward/risk ratios and require careful strategy and education.

Why do people lose money in binary options?

People often lose money in binary options due to the lack of a clear strategy, the all-or-nothing nature, and the higher risk relative to the reward.

What is the problem with binary options?

Binary options have some cons, like any other trading instrument. These include low reward/risk ratios, regulatory issues, and the potential for fraud from unregulated brokers.