Pocket Option Overview

If you’re new to Pocket Option, let me keep it simple. It’s one of the best binary options brokers where traders can place quick trades on different markets like forex, crypto, and stocks.

The idea is straightforward: you predict whether the price will go up or down within a set time. If you’re right, you win. If not, you lose the stake. But to be right more often than not, you’ll need a proper pocket option strategy. And that’s what this article is all about.

- A solid Pocket Option strategy is essential for consistency and avoiding emotional trading.

- Indicators like moving averages, Fractal Chaos Bands, and the Vortex can help confirm setups.

- Chart patterns such as flags and wedges give clear entry and expiry signals.

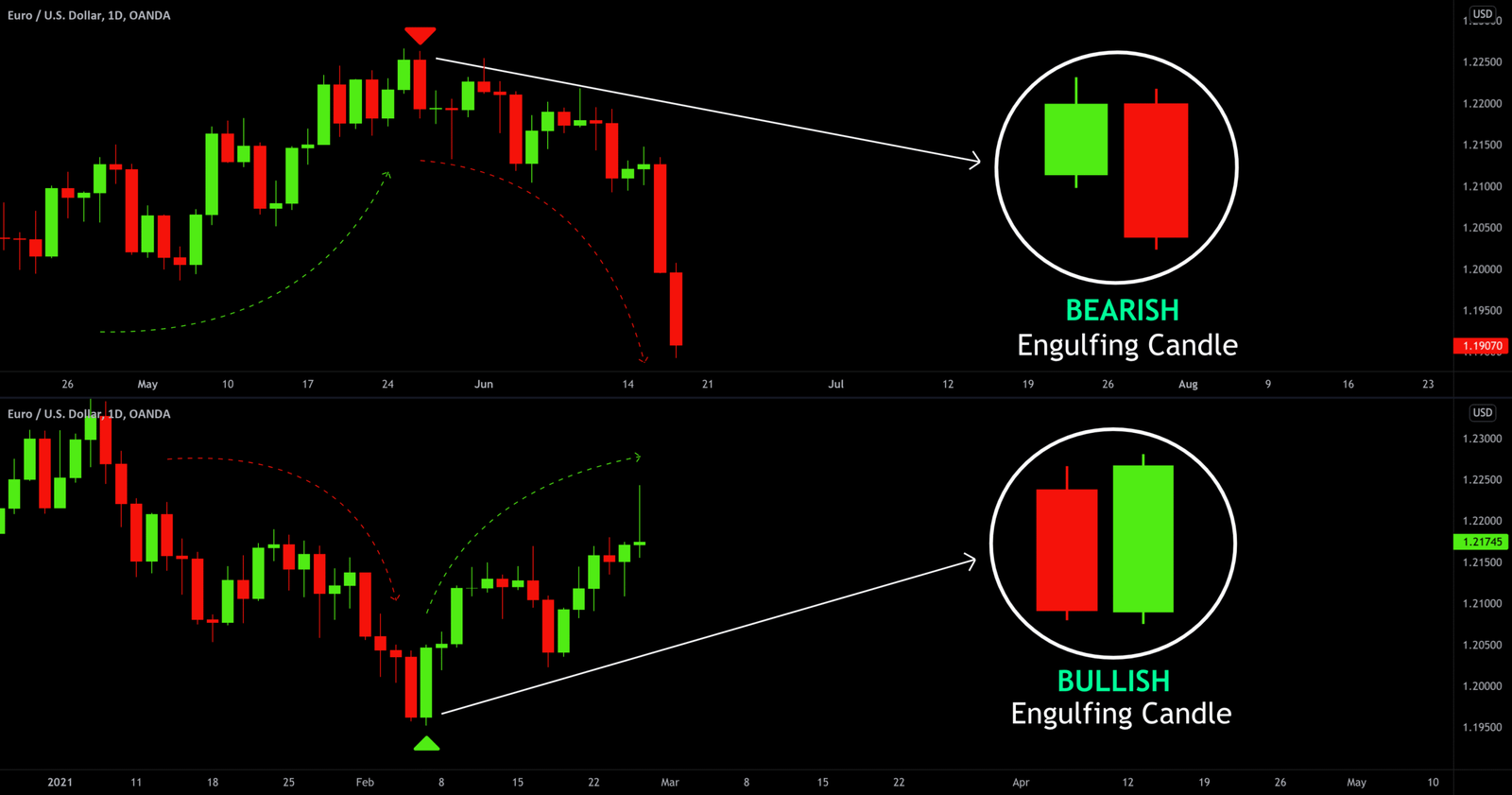

- Candlestick patterns (Engulfing, Hammers, Shooting Stars) work well for spotting reversals.

- The 1-minute OB + FVG strategy is powerful for scalping with precision.

- Stick to 3–5 candle expiries for most setups on short timeframes.

- Trading during active sessions like London and New York increases your chances of success.

- Risk management and a clear trading plan are more important than chasing signals.

Introduction to Pocket Option and Binary Options

Binary options are a variant of option contracts with a binary payout. They are fast, and that’s why traders love them. But it’s also why so many people lose money. Without a clear plan, it’s just guessing. And guessing doesn’t last long in trading.

That’s where your pocket option trading strategy comes in. A solid strategy gives you rules to follow. It tells you when to enter, when to wait, and when to close.

Pocket Option, which is arguably the most popular binary options broker, makes it easy to try different approaches. So, you can trade both longer timeframes and shorter ones like the 1-minute chart.

But of course, scalping is not for everyone. And even longer-term trading is very difficult. That’s why the methods I introduce in this article can be used as a pocket option 1-minute strategy, or on much higher timeframes.

Why Having a Pocket Option Trading Strategy Matters

Trading on Pocket Option can be exciting, but excitement alone won’t make you money. The platform is fast, and the trades are quick. I mean, emotions can easily take over. That’s why having a Pocket Option strategy isn’t just helpful, but necessary.

A Pocket Option strategy gives you structure. It keeps you from chasing every move and teaches you to wait for the right setups. Instead of reacting to every candle, you follow clear rules. This is how you stay consistent, avoid blowing your account, and get to that significant Pocket Option withdrawal you’ve always wanted.

In the next sections, I’ll walk you through different types of Pocket Option trading strategies. We’ll look at approaches that use indicators, chart patterns, candlestick signals, and even a short-term pocket option strategy 1-minute traders can use. Each one has its own strengths, and you can forward test trading strategies on a binary options demo account to see which fits your style best.

Best Pocket Option Strategies With Indicators

One of the simplest ways to trade on Pocket Option is by using technical indicators. They give you signals based on math and price behavior, so you’re not just guessing. Let’s look at a few indicators that you can use to build the best Pocket Option strategy for you.

Moving Averages

Moving averages are among the most popular tools. They smooth out the price and show you the trend. A simple pocket option strategy is to use two moving averages. One should be faster and the other one slower.

For instance, you can use two moving averages with 7 and 21 periods (the one with the period 7 is clearly the faster). When the faster-moving average crosses above the slow line, it’s a buy signal. When it crosses below, it’s a sell signal. This works well for spotting changes in momentum and catching those big moves early on.

You can easily use the free Pocket Option demo account to test this strategy and other ones live.

Fractal Chaos Bands

The Fractal Chaos Bands (FCB) indicator is simple to read and doesn’t overload your chart with signals. It’s actually a very helpful tool to include in your Pocket Option strategy. The FCB forms bands that show potential breakout levels. A solid Pocket Option strategy with FCB is to trade those breakouts.

Here’s how I do it:

- Set the FCB period to 1–3, depending on your preference.

- Wait for the price to break out of the bands.

- Enter after the breakout candle closes in the same direction.

- Set the expiry to 3–5 candles after the entry. For example, on a 1-minute chart, use a 3–5 minute expiry.

This approach is straightforward and works well in active markets. Of course, you can adjust the settings to your style, but I recommend sticking to strong trading sessions where volatility gives you the best setups.

Vortex Indicator

The Vortex Indicator was introduced in 2010 and has quickly become a reliable trend tool. It uses two lines — +V (positive vortex) and -V (negative vortex). When +V is above -V, it confirms an uptrend. When the -V line is on top, the trend is down. The wider the gap between the lines, the stronger the trend.

Here’s a simple pocket option strategy using Vortex:

- Use the default setting of 14 for balance. If you want more signals, try 7 or 10. For longer trades, go with 20–30.

- Wait for a crossover: when +V crosses above -V, it’s a bullish signal. When -V crosses above +V, it’s bearish.

- Enter your trade in the same direction after the crossover candle closes.

- Set the expiry to 3–5 candles ahead. For example, if you’re on a 1-minute chart, go for a 3–5 minute expiry.

This works especially well if you combine it with price action, like support and resistance levels. I’ve seen it filter out false moves and give cleaner signals during trending markets.

Honorable Mentions

There are also a few other indicators I like to add to my chart from time to time, not as my main Pocket Option strategy but as extra confirmation. The Accelerator Oscillator by Bill Williams is useful for spotting when momentum is picking up or slowing down before the price makes a big move.

Moreover, the DMI (Directional Movement Index) helps me check the strength of a trend, so I don’t enter weak setups. And finally, the Aroon Indicator is great for spotting when a new trend might be starting.

Remember, I don’t rely on these alone. But when I need more confidence, they add solid support to my main pocket option strategy.

Pocket Option Strategies Using Chart Patterns

Chart patterns are one of my favorite ways to trade on Pocket Option. They’re simple to spot once you train your eyes, and they often give reliable signals.

Patterns form because traders behave in repeatable ways, and that psychology shows up on the chart. Two of the most useful patterns for your pocket option trading strategy are the Flag Pattern and the Wedge Pattern.

Trading the Flag Pattern on Pocket Option

The flag pattern looks exactly like its name: a pole with a flag attached. First, you’ll see a strong move (the pole), followed by a tight consolidation (the flag). Flags can be bullish or bearish, depending on the direction of the trend.

Here’s how I trade it on Pocket Option:

- Wait for a sharp move with momentum (either up or down).

- Spot a flag forming, which is a small channel moving against the trend.

- Enter when the breakout candle closes outside the flag.

- For binary options, I usually set the expiry to 3–5 candles ahead. On a 1-minute chart, that’s 3–5 minutes.

It’s straightforward, and I’ve found that this Pocket Option strategy works best when traded during active sessions where the market has strong momentum.

Trading the Wedge Pattern on Pocket Option

The wedge pattern is another powerful setup. It comes in two types: rising wedge and falling wedge. Both form when trendlines squeeze price into a narrowing range.

- A rising wedge usually signals weakness in an uptrend. Buyers are running out of steam, and the breakout often happens to the downside.

- A falling wedge shows sellers losing control. Even though the price is moving lower, momentum is fading, and the breakout is usually upward.

Here’s my Pocket Option strategy :

- Identify a wedge by drawing lines across the highs and lows as they converge.

- Wait for the breakout in the expected direction (down for a rising wedge, up for a falling wedge).

- Enter after the breakout candle closes.

- Again, set the expiry to 3–5 candles later for binary options.

Wedges are reliable when combined with volume or momentum indicators. I often check the Vortex indicator for confirmation before I place my trade.

Pocket Option Strategies with Candlesticks

Candlestick patterns are some of the most reliable signals you’ll find in trading. They don’t just show price; they tell a story about buyers and sellers fighting for control.

On Pocket Option, I like using them because they’re quick to spot and easy to combine with expiry times. Let’s look at two of the strongest setups: Engulfing candles and Hammer/Shooting Star patterns.

Engulfing Candles

Engulfing patterns signal a potential turn. A bullish engulfing forms at the end of a drop: a strong green candle fully covers the body of the prior red candle. A bearish engulfing shows up near the end of a rally: a strong red candle swallows the prior green candle. Simple idea—one candle wipes out the last one and shifts control.

Now, here’s how I use it in my Pocket Option strategy:

- Mark key support (for bullish) or resistance (for bearish).

- Wait for the engulfing candle to close. No early entries.

- Optional but smart: look for confirmation, like RSI divergence, Vortex/Aroon alignment, or a small pullback that holds the level.

- Entry: after the engulfing candle closes (or on a tiny retest).

- Expiry: 3–5 candles ahead. On M1 charts, that’s 3–5 minutes.

A few tips: at clean levels, the pattern has more weight. Big bodies beat small ones. Don’t trade it in the middle of a messy range. These tips can create a winning Pocket Option strategy from most candlestick patterns.

Hammers and Shooting Stars

These are single-candle reversal signals. A hammer candlestick pattern (bullish) has a tiny body near the top and a long lower wick—buyers rejected lower prices. It works best after a drop, near support, or a demand zone.

A shooting star (bearish) is the mirror image: small body near the bottom and a long upper wick—buyers got stuffed and sellers took over. It’s stronger after an uptrend and near resistance or a supply zone.

What I look for:

- Clear prior move into the level. Location matters more than the candle alone.

- Confirmation: the next candle closes in the expected direction (above a hammer’s high, or below a shooting star’s low). Volume or a momentum cue (Vortex/Aroon/RSI) adds confidence.

- Entry: on the confirmation close or a tight pullback into the wick/body.

- Expiry: 3–5 candles. On the 1-minute chart, that’s 3–5 minutes.

Extra notes: color isn’t everything, but a red (bearish) shooting star often hits harder, and a green (bullish) hammer is usually cleaner. If the price breaks the wick extremes right after entry, the signal is likely invalid. Skip it or wait for more confluence.

Profitable Pocket Option 1-Minute Strategy

When it comes to fast trading like the 1-minute chart on Pocket Option, you need setups that are sharp, clean, and based on real market mechanics.

The best Pocket Option strategy on lower timeframes, in my opinion, is an ICT-style strategy using Order Blocks (OBs) and Fair Value Gaps (FVGs). These concepts focus on liquidity and how big money actually trades, which makes them much stronger for you to build your Pocket Option 1-minute strategy on.

This is a strategy you can also use in Pocket Option tournaments to beat other traders. However, you must master it first. Here are the steps:

Step 1: Spot the Market Structure

Start with the basics. If the price is making higher highs and higher lows, the structure is bullish. If it’s making lower highs and lower lows, the structure is bearish. Only trade in the direction of the main structure. That’s your edge.

Step 2: Identify Order Blocks

An Order Block is simply the last opposite candle before a strong move.

- In a bullish market, the last bearish candle before a rally is your bullish OB.

- In a bearish market, the last bullish candle before a strong drop is your bearish OB.

Why do these zones matter? Because they’re where institutions left their limit orders. Price loves to revisit them, tap liquidity, and then continue in the main direction.

Step 3: Use Fair Value Gaps for Precision

A Fair Value Gap (FVG) is the imbalance between three candles when the price moves aggressively in one direction. They act as magnets. Price often returns to fill part of the gap before resuming the trend.

- In a bullish setup, look for a bullish FVG below the current price.

- In a bearish setup, look for a bearish FVG above the current price.

When OBs and FVGs line up in the same area, that’s your high-probability entry zone.

Step 4: Trade Execution (1-Minute Pocket Option Setup)

Here’s how I set it up:

- Confirm the trend with the market structure.

- Wait for the price to pull back into a valid OB that also aligns with an FVG.

- Once price taps the level and shows a rejection, enter your trade in the trend’s direction.

- Set the expiry to 3–5 candles ahead. On a 1-minute chart, that’s 3–5 minutes.

Step 5: Timing Matters

Not every pullback is worth trading. This strategy works best during active market hours, especially during the ICT Killzones (London Open, New York AM session). That’s when liquidity is high, and order blocks/FVGs are respected more cleanly.

Tips for Building a Consistent Pocket Option Trading Plan

Having good strategies is one thing, but without a plan, you’ll still struggle. Binary options are fast, and emotions can easily take over. A trading plan is what keeps you steady.

First, decide when you’ll trade. Stick to the active market sessions like London or New York. These times give you better moves and cleaner signals. Randomly opening trades during quiet hours usually ends in losses.

Second, focus on risk management. Don’t risk more than a small percentage of your account on one trade. Even the best setups fail sometimes, and you need to protect your capital so you can keep trading.

Third, choose just a couple of Pocket Option strategies and master them. Jumping between five or six methods will only confuse you. Once you’re confident with one or two, your consistency will improve.

Lastly, keep a trading journal. Write down why you took each trade, what worked, and what didn’t. Over time, you’ll see patterns in your behavior and find ways to improve yourself and your Pocket Option strategy.

A plan doesn’t have to be complicated. It just has to keep you disciplined and focused on the long game.

If you still have issues creating your own strategy, you can check out Pocket Option copy trading and how it works.

Conclusion

Trading on Pocket Option can be rewarding. But, of course, only if you treat it seriously. Strategies like moving averages, order blocks, candlestick signals, and chart patterns give you structure and keep you from guessing. With the right setups, discipline, and timing, even short timeframes like the 1-minute chart can offer profitable opportunities.

At the end of the day, consistency is what matters most. Pick a Pocket Option strategy that fits your style and manage your risk. Also, make sure to keep learning from your trades, and don’t expect overnight success. With patience and practice, you’ll find your edge. That’s how I did it.

CrypOption Hub contains affiliate links to various brokers and platforms. We may earn a commission if you choose to register or trade through these links. This is how we support our work and continue offering in-depth reviews, strategies, and trader-focused content. That said, we only promote services we have personally tested or trust. Trading binary options carries risk, and we encourage readers to trade responsibly. For full details, please read our Disclaimers page.